Page 1562 - draft

P. 1562

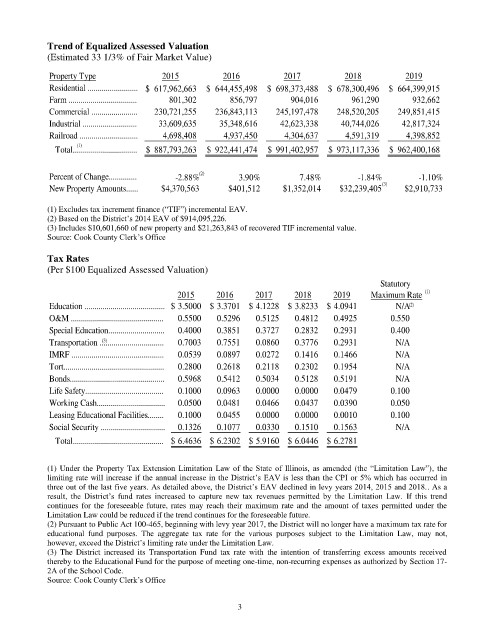

Trend of Equalized Assessed Valuation

(Estimated 33 1/3% of Fair Market Value)

Property Type 2015 2016 2017 2018 2019

Residential ......................... $ 617,962,663 $ 644,455,498 $ 698,373,488 $ 678,300,496 $ 664,399,915

Farm .................................. 801,302 856,797 904,016 961,290 932,662

Commercial ....................... 230,721,255 236,843,113 245,197,478 248,520,205 249,851,415

Industrial ........................... 33,609,635 35,348,616 42,623,338 40,744,026 42,817,324

Railroad ............................. 4,698,408 4,937,450 4,304,637 4,591,319 4,398,852

(1)

Total................................ $ 887,793,263 $ 922,441,474 $ 991,402,957 $ 973,117,336 $ 962,400,168

Percent of Change.............. -2.88% (2) 3.90% 7.48% -1.84% -1.10%

New Property Amounts...... $4,370,563 $401,512 $1,352,014 $32,239,405 (3) $2,910,733

(1) Excludes tax increment finance (“TIF”) incremental EAV.

(2) Based on the District’s 2014 EAV of $914,095,226.

(3) Includes $10,601,660 of new property and $21,263,843 of recovered TIF incremental value.

Source: Cook County Clerk’s Office

Tax Rates

(Per $100 Equalized Assessed Valuation)

Statutory

2015 2016 2017 2018 2019 Maximum Rate (1)

Education ........................................ $ 3.5000 $ 3.3701 $ 4.1228 $ 3.8233 $ 4.0941 N/A (2)

O&M .............................................. 0.5500 0.5296 0.5125 0.4812 0.4925 0.550

Special Education............................ 0.4000 0.3851 0.3727 0.2832 0.2931 0.400

Transportation ................................ 0.7003 0.7551 0.0860 0.3776 0.2931 N/A

(3)

IMRF .............................................. 0.0539 0.0897 0.0272 0.1416 0.1466 N/A

Tort.................................................. 0.2800 0.2618 0.2118 0.2302 0.1954 N/A

Bonds............................................... 0.5968 0.5412 0.5034 0.5128 0.5191 N/A

Life Safety....................................... 0.1000 0.0963 0.0000 0.0000 0.0479 0.100

Working Cash.................................. 0.0500 0.0481 0.0466 0.0437 0.0390 0.050

Leasing Educational Facilities........ 0.1000 0.0455 0.0000 0.0000 0.0010 0.100

Social Security ................................ 0.1326 0.1077 0.0330 0.1510 0.1563 N/A

Total............................................. $ 6.4636 $ 6.2302 $ 5.9160 $ 6.0446 $ 6.2781

(1) Under the Property Tax Extension Limitation Law of the State of Illinois, as amended (the “Limitation Law”), the

limiting rate will increase if the annual increase in the District’s EAV is less than the CPI or 5% which has occurred in

three out of the last five years. As detailed above, the District’s EAV declined in levy years 2014, 2015 and 2018.. As a

result, the District’s fund rates increased to capture new tax revenues permitted by the Limitation Law. If this trend

continues for the foreseeable future, rates may reach their maximum rate and the amount of taxes permitted under the

Limitation Law could be reduced if the trend continues for the foreseeable future.

(2) Pursuant to Public Act 100-465, beginning with levy year 2017, the District will no longer have a maximum tax rate for

educational fund purposes. The aggregate tax rate for the various purposes subject to the Limitation Law, may not,

however, exceed the District’s limiting rate under the Limitation Law.

(3) The District increased its Transportation Fund tax rate with the intention of transferring excess amounts received

thereby to the Educational Fund for the purpose of meeting one-time, non-recurring expenses as authorized by Section 17-

2A of the School Code.

Source: Cook County Clerk’s Office

3