Page 1563 - draft

P. 1563

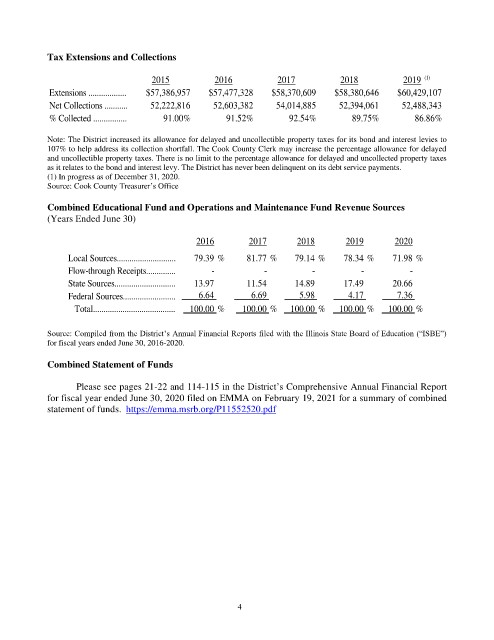

Tax Extensions and Collections

2015 2016 2017 2018 2019 (1)

Extensions .................. $57,386,957 $57,477,328 $58,370,609 $58,380,646 $60,429,107

Net Collections ........... 52,222,816 52,603,382 54,014,885 52,394,061 52,488,343

% Collected ................ 91.00% 91.52% 92.54% 89.75% 86.86%

Note: The District increased its allowance for delayed and uncollectible property taxes for its bond and interest levies to

107% to help address its collection shortfall. The Cook County Clerk may increase the percentage allowance for delayed

and uncollectible property taxes. There is no limit to the percentage allowance for delayed and uncollected property taxes

as it relates to the bond and interest levy. The District has never been delinquent on its debt service payments.

(1) In progress as of December 31, 2020.

Source: Cook County Treasurer’s Office

Combined Educational Fund and Operations and Maintenance Fund Revenue Sources

(Years Ended June 30)

2016 2017 2018 2019 2020

Local Sources............................ 79.39 % 81.77 % 79.14 % 78.34 % 71.98 %

Flow-through Receipts.............. - - - - -

State Sources............................. 13.97 11.54 14.89 17.49 20.66

Federal Sources......................... 6.64 6.69 5.98 4.17 7.36

Total....................................... 100.00 % 100.00 % 100.00 % 100.00 % 100.00 %

Source: Compiled from the District’s Annual Financial Reports filed with the Illinois State Board of Education (“ISBE”)

for fiscal years ended June 30, 2016-2020.

Combined Statement of Funds

Please see pages 21-22 and 114-115 in the District’s Comprehensive Annual Financial Report

for fiscal year ended June 30, 2020 filed on EMMA on February 19, 2021 for a summary of combined

statement of funds. https://emma.msrb.org/P11552520.pdf

4