Page 12 - GSP_Residences_at_Linden_OM_Equity

P. 12

THE

NUMBERS

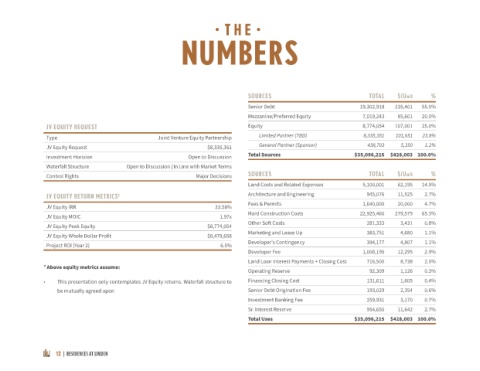

SOURCES TOTAL $/Unit %

Senior Debt 19,302,918 235,401 55.0%

Mezzanine/Preferred Equity 7,019,243 85,601 20.0%

JV EQUITY REQUEST Equity 8,774,054 107,001 25.0%

Type Joint Venture Equity Partnership Limited Partner (TBD) 8,335,351 101,651 23.8%

JV Equity Request $8,335,351 General Partner (Sponsor) 438,703 5,350 1.2%

Investment Horizion Open to Discussion Total Sources $35,096,215 $428,003 100.0%

Waterfall Structure Open to Discussion | In Line with Market Terms

Control Rights Major Decisions SOURCES TOTAL $/Unit %

Land Costs and Related Expenses 5,100,001 62,195 14.5%

JV EQUITY RETURN METRICS¹ Architecture and Engineering 945,076 11,525 2.7%

Fees & Permits 1,640,000 20,000 4.7%

JV Equity IRR 33.58%

Hard Construction Costs 22,925,460 279,579 65.3%

JV Equity MOIC 1.97x

Other Soft Costs 281,333 3,431 0.8%

JV Equity Peak Equity $8,774,054

Marketing and Lease Up 383,751 4,680 1.1%

JV Equity Whole Dollar Profit $8,479,658

Developer's Contingency 394,177 4,807 1.1%

Project ROI (Year 2) 6.5%

Developer Fee 1,008,195 12,295 2.9%

Land Loan Interest Payments + Closing Cost 716,500 8,738 2.0%

¹ Above equity metrics assume:

Operating Reserve 92,309 1,126 0.3%

• This presentation only contemplates JV Equity returns. Waterfall structure to Financing Closing Cost 131,611 1,605 0.4%

be mutually agreed upon Senior Debt Origination Fee 193,029 2,354 0.6%

Investment Banking Fee 259,931 3,170 0.7%

Sr. Interest Reserve 954,650 11,642 2.7%

Total Uses $35,096,215 $428,003 100.0%

12 | RESIDENCES AT LINDEN