Page 12 - 12202017 Bryant Test 2

P. 12

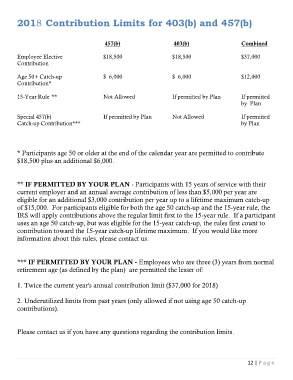

2018 Contribution Limits for 403(b) and 457(b)

457(b) 403(b) Combined

Employee Elective $18,500 $18,500 $37,000

Contribution

Age 50+ Catch-up $ 6,000 $ 6,000 $12,000

Contribution*

15-Year Rule ** Not Allowed If permitted by Plan If permitted

by Plan

Special 457(b) If permitted by Plan Not Allowed If permitted

Catch-up Contribution*** by Plan

* Participants age 50 or older at the end of the calendar year are permitted to contribute

$18,500 plus an additional $6,000.

** IF PERMITTED BY YOUR PLAN - Participants with 15 years of service with their

current employer and an annual average contribution of less than $5,000 per year are

eligible for an additional $3,000 contribution per year up to a lifetime maximum catch-up

of $15,000. For participants eligible for both the age 50 catch-up and the 15-year rule, the

IRS will apply contributions above the regular limit first to the 15-year rule. If a participant

uses an age 50 catch-up, but was eligible for the 15-year catch-up, the rules first count to

contribution toward the 15-year catch-up lifetime maximum. If you would like more

information about this rules, please contact us.

*** IF PERMITTED BY YOUR PLAN - Employees who are three (3) years from normal

retirement age (as defined by the plan) are permitted the lesser of:

1. Twice the current year's annual contribution limit ($37,000 for 2018)

2. Underutilized limits from past years (only allowed if not using age 50 catch-up

contributions).

Please contact us if you have any questions regarding the contribution limits.

12 | P a g e