Page 17 - 12202017 Bryant Test 2

P. 17

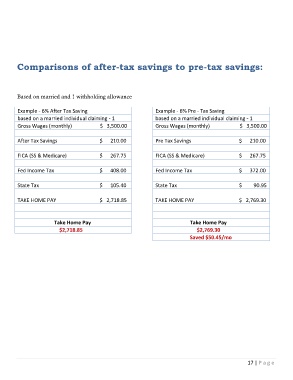

Comparisons of after-tax savings to pre-tax savings:

Based on married and 1 withholding allowance

Example - 6% After Tax Saving Example - 6% Pre - Tax Saving

based on a married individual claiming - 1 based on a married individual claiming - 1

Gross Wages (monthly) $ 3,500.00 Gross Wages (monthly) $ 3,500.00

After Tax Savings $ 210.00 Pre Tax Savings $ 210.00

FICA (SS & Medicare) $ 267.75 FICA (SS & Medicare) $ 267.75

Fed Income Tax $ 408.00 Fed Income Tax $ 372.00

State Tax $ 105.40 State Tax $ 90.95

TAKE HOME PAY $ 2,718.85 TAKE HOME PAY $ 2,769.30

Take Home Pay Take Home Pay

$2,718.85 $2,769.30

Saved $50.45/mo

17 | P a g e