Page 17 - The ultimate homebuyers guide - preview

P. 17

Your Latest Home Buying Guide

or backed by the government. Convention loans that follow the

guidelines set by the government-sponsored entities (Fannie Mae

and Freddie Mac) and are called “conforming.” Non-conforming

loans have their own standards.

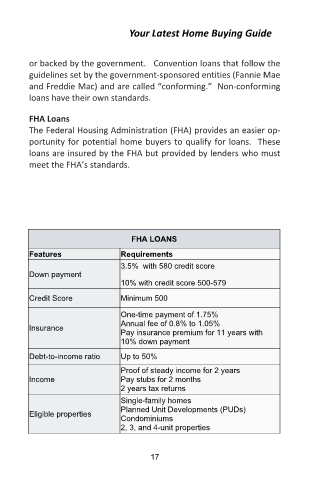

FHA Loans

The Federal Housing Administration (FHA) provides an easier op-

portunity for potential home buyers to qualify for loans. These

loans are insured by the FHA but provided by lenders who must

meet the FHA’s standards.

FHA LOANS

Features Requirements

3.5% with 580 credit score

Down payment

10% with credit score 500-579

Credit Score Minimum 500

One-time payment of 1.75%

Annual fee of 0.8% to 1.05%

Insurance

Pay insurance premium for 11 years with

10% down payment

Debt-to-income ratio Up to 50%

Proof of steady income for 2 years

Income Pay stubs for 2 months

2 years tax returns

Single-family homes

Planned Unit Developments (PUDs)

Eligible properties

Condominiums

2, 3, and 4-unit properties

17