Page 21 - The ultimate homebuyers guide - preview

P. 21

Your Latest Home Buying Guide

The importance of a good downpayment

There may be lenders out there who want to lend you 100% of the

price of your home. While this looks good on the face of it, you will

be doing more harm to your future and your financial health.

Remember that the more you borrow, the larger your debt will be,

and the more you will have to pay back. This leaves less in savings

to enjoy life, and take care of other important activities.

Minimum down payment range from 3% for Conventional loans

and 3.5% for FHA loans.

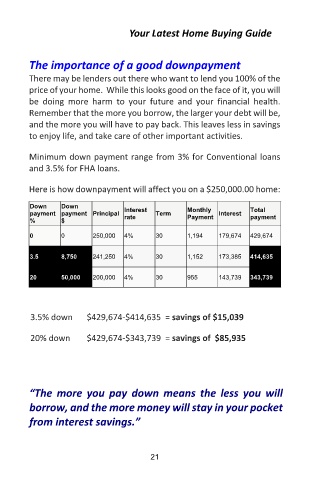

Here is how downpayment will affect you on a $250,000.00 home:

Down Down Interest Monthly Total

payment payment Principal Term Interest

% $ rate Payment payment

0 0 250,000 4% 30 1,194 179,674 429,674

3.5 8,750 241,250 4% 30 1,152 173,385 414,635

20 50,000 200,000 4% 30 955 143,739 343,739

3.5% down $429,674-$414,635 = savings of $15,039

20% down $429,674-$343,739 = savings of $85,935

“The more you pay down means the less you will

borrow, and the more money will stay in your pocket

from interest savings.”

21