Page 20 - The ultimate homebuyers guide - preview

P. 20

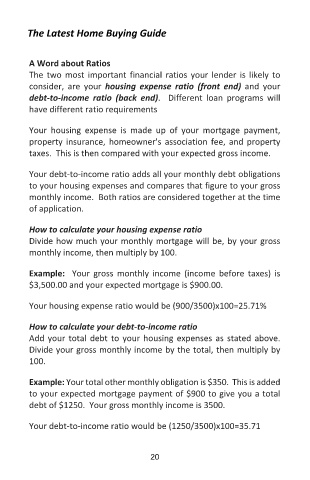

The Latest Home Buying Guide

A Word about Ratios

The two most important financial ratios your lender is likely to

consider, are your housing expense ratio (front end) and your

debt-to-income ratio (back end). Different loan programs will

have different ratio requirements

Your housing expense is made up of your mortgage payment,

property insurance, homeowner's association fee, and property

taxes. This is then compared with your expected gross income.

Your debt-to-income ratio adds all your monthly debt obligations

to your housing expenses and compares that figure to your gross

monthly income. Both ratios are considered together at the time

of application.

How to calculate your housing expense ratio

Divide how much your monthly mortgage will be, by your gross

monthly income, then multiply by 100.

Example: Your gross monthly income (income before taxes) is

$3,500.00 and your expected mortgage is $900.00.

Your housing expense ratio would be (900/3500)x100=25.71%

How to calculate your debt-to-income ratio

Add your total debt to your housing expenses as stated above.

Divide your gross monthly income by the total, then multiply by

100.

Example: Your total other monthly obligation is $350. This is added

to your expected mortgage payment of $900 to give you a total

debt of $1250. Your gross monthly income is 3500.

Your debt-to-income ratio would be (1250/3500)x100=35.71

20