Page 17 - Benefits Guide

P. 17

Retirement Benefits

You are eligible to participate in the 401(k) plan if you are at least 21 years old (PRN or temporary employees are not eligible). For 2019, previously excluded highly compensated employees (HCEs) will be eligible to participate in the 401(k) plan.

Enrollment

Please note the enrollment process differs by plan:

401(k) plan: Prudential will send you information 30 days before you are eligible to enroll. You may enroll at any time

thereafter, online or by phone: www.prudential.com/online/retirement or 1-877-778-2100.

Deferred Compensation Plan: Unlike a 401(k) plan, you must enroll each year to continue to participate in this plan. If you do not enroll when you are first eligible, you must wait until the next year to participate. If you are eligible, you will receive information via email (both initially and annually). Contact customer service at: 1-877-778-2100.

401(k)/Deferred Compensation Plan Highlights

Retirement Benefits

Participation

You are eligible to participate on the first of the month after you have completed 60 days of continuous service.* Your participation, with contributions from your paycheck, will begin on the first day of the month after you enroll, or as soon as administratively possible.

Contributions

You can contribute any amount from 1% to 50% of your eligible pay (subject to the plan’s limits). Your elected percentage of eligible pay will be automatically deducted each payday.

Your contributions are deducted on a before-tax basis. This means you do not pay income taxes on plan contributions or their earnings until you take them out of the plan. In addition, Corizon Health provides a company-matching contribution (401(k) only) to your account (subject to vesting) of 50 cents for every dollar you contribute, up to a maximum employee contribution of 4% of your eligible pay (subject to plan limits).*

401(k) plan only: The plan also permits additional “catch-up contributions” by older employees who are approaching retirement (age 50 or older).

*Subject to collective bargaining agreement.

Investment Options

You select the funds in which you want to invest your contributions. You have a number of investment funds to choose from, of different types, which you can review online at www.prudential.com/online/retirement.

Vesting

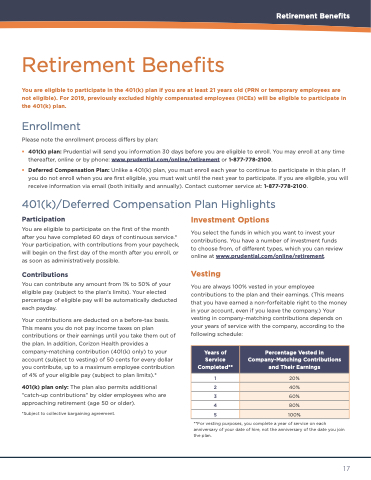

You are always 100% vested in your employee contributions to the plan and their earnings. (This means that you have earned a non-forfeitable right to the money in your account, even if you leave the company.) Your vesting in company-matching contributions depends on your years of service with the company, according to the following schedule:

Years of Service Completed**

Percentage Vested in Company-Matching Contributions and Their Earnings

1

20%

2

40%

3

60%

4

80%

5

100%

**For vesting purposes, you complete a year of service on each anniversary of your date of hire, not the anniversary of the date you join the plan.

17