Page 12 - Pre-Approval Folder

P. 12

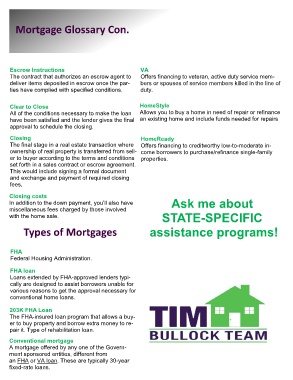

Mortgage Glossary Con.

Escrow Instructions VA

The contract that authorizes an escrow agent to Offers financing to veteran, active duty service mem-

deliver items deposited in escrow once the par- bers or spouses of service members killed in the line of

ties have complied with specified conditions. duty.

Clear to Close HomeStyle

All of the conditions necessary to make the loan Allows you to buy a home in need of repair or refinance

have been satisfied and the lender gives the final an existing home and include funds needed for repairs

approval to schedule the closing.

Closing HomeReady

The final stage in a real estate transaction where Offers financing to creditworthy low-to-moderate in-

ownership of real property is transferred from sell- come borrowers to purchase/refinance single-family

er to buyer according to the terms and conditions properties.

set forth in a sales contract or escrow agreement.

This would include signing a formal document

and exchange and payment of required closing

fees.

Closing costs

In addition to the down payment, you’ll also have Ask me about

miscellaneous fees charged by those involved

with the home sale. STATE-SPECIFIC

Types of Mortgages assistance programs!

FHA

Federal Housing Administration.

FHA loan

Loans extended by FHA-approved lenders typi-

cally are designed to assist borrowers unable for

various reasons to get the approval necessary for

conventional home loans.

203K FHA Loan

The FHA-insured loan program that allows a buy-

er to buy property and borrow extra money to re-

pair it. Type of rehabilitation loan.

Conventional mortgage

A mortgage offered by any one of the Govern-

ment sponsored entities, different from

an FHA or VA loan. These are typically 30-year

fixed-rate loans.