Page 11 - cfi-Accounting-eBook

P. 11

The Corporate Finance Institute Accounting

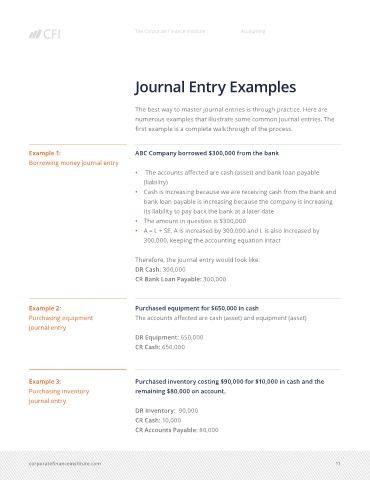

Journal Entry Examples

The best way to master journal entries is through practice. Here are

numerous examples that illustrate some common journal entries. The

first example is a complete walkthrough of the process.

Example 1: ABC Company borrowed $300,000 from the bank

Borrowing money journal entry

• The accounts affected are cash (asset) and bank loan payable

(liability)

• Cash is increasing because we are receiving cash from the bank and

bank loan payable is increasing because the company is increasing

its liability to pay back the bank at a later date

• The amount in question is $300,000

• A = L + SE, A is increased by 300,000 and L is also increased by

300,000, keeping the accounting equation intact

Therefore, the journal entry would look like:

DR Cash: 300,000

CR Bank Loan Payable: 300,000

Example 2: Purchased equipment for $650,000 in cash

Purchasing equipment The accounts affected are cash (asset) and equipment (asset)

journal entry

DR Equipment: 650,000

CR Cash: 650,000

Example 3: Purchased inventory costing $90,000 for $10,000 in cash and the

Purchasing inventory remaining $80,000 on account.

journal entry

DR Inventory: 90,000

CR Cash: 10,000

CR Accounts Payable: 80,000

corporatefinanceinstitute.com 11