Page 6 - cfi-Accounting-eBook

P. 6

The Corporate Finance Institute Accounting

Accrual vs Cash Basis

of Accounting

In order to properly implement bookkeeping, companies need to first

choose the accounting method they will follow. Companies can choose

between two basic accounting methods: the cash basis of accounting or

the accrual basis of accounting. The difference between these types of

accounting is based on when you, the company, actually record the sale

(money inflow) or purchase (money outflow) in the books.

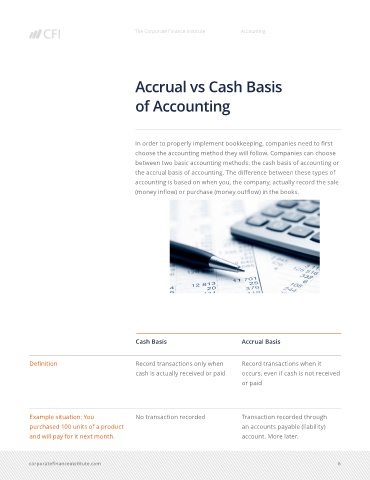

Cash Basis Accrual Basis

Definition Record transactions only when Record transactions when it

cash is actually received or paid occurs, even if cash is not received

or paid

Example situation: You No transaction recorded Transaction recorded through

purchased 100 units of a product an accounts payable (liability)

and will pay for it next month. account. More later.

corporatefinanceinstitute.com 6