Page 175 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 175

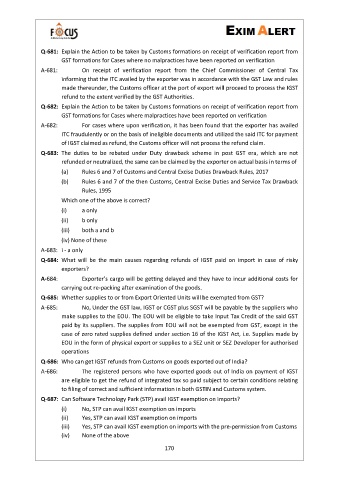

Q-681: Explain the Action to be taken by Customs formations on receipt of verification report from

GST formations for Cases where no malpractices have been reported on verification

A-681: On receipt of verification report from the Chief Commissioner of Central Tax

informing that the ITC availed by the exporter was in accordance with the GST Law and rules

made thereunder, the Customs officer at the port of export will proceed to process the IGST

refund to the extent verified by the GST Authorities.

Q-682: Explain the Action to be taken by Customs formations on receipt of verification report from

GST formations for Cases where malpractices have been reported on verification

A-682: For cases where upon verification, it has been found that the exporter has availed

ITC fraudulently or on the basis of ineligible documents and utilized the said ITC for payment

of IGST claimed as refund, the Customs officer will not process the refund claim.

Q-683: The duties to be rebated under Duty drawback scheme in post GST era, which are not

refunded or neutralized, the same can be claimed by the exporter on actual basis in terms of

(a) Rules 6 and 7 of Customs and Central Excise Duties Drawback Rules, 2017

(b) Rules 6 and 7 of the then Customs, Central Excise Duties and Service Tax Drawback

Rules, 1995

Which one of the above is correct?

(i) a only

(ii) b only

(iii) both a and b

(iv) None of these

A-683: i - a only

Q-684: What will be the main causes regarding refunds of IGST paid on import in case of risky

exporters?

A-684: Exporter’s cargo will be getting delayed and they have to incur additional costs for

carrying out re-packing after examination of the goods.

Q-685: Whether supplies to or from Export Oriented Units will be exempted from GST?

A-685: No, Under the GST law, IGST or CGST plus SGST will be payable by the suppliers who

make supplies to the EOU. The EOU will be eligible to take Input Tax Credit of the said GST

paid by its suppliers. The supplies from EOU will not be exempted from GST, except in the

case of zero rated supplies defined under section 16 of the IGST Act, i.e. Supplies made by

EOU in the form of physical export or supplies to a SEZ unit or SEZ Developer for authorised

operations

Q-686: Who can get IGST refunds from Customs on goods exported out of India?

A-686: The registered persons who have exported goods out of India on payment of IGST

are eligible to get the refund of integrated tax so paid subject to certain conditions relating

to filing of correct and sufficient information in both GSTIN and Customs system.

Q-687: Can Software Technology Park (STP) avail IGST exemption on imports?

(i) No, STP can avail IGST exemption on imports

(ii) Yes, STP can avail IGST exemption on imports

(iii) Yes, STP can avail IGST exemption on imports with the pre-permission from Customs

(iv) None of the above

170