Page 181 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 181

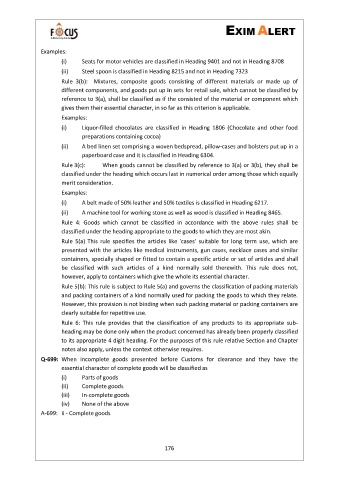

Examples:

(i) Seats for motor vehicles are classified in Heading 9401 and not in Heading 8708

(ii) Steel spoon is classified in Heading 8215 and not in Heading 7323

Rule 3(b): Mixtures, composite goods consisting of different materials or made up of

different components, and goods put up in sets for retail sale, which cannot be classified by

reference to 3(a), shall be classified as if the consisted of the material or component which

gives them their essential character, in so far as this criterion is applicable.

Examples:

(i) Liquor-filled chocolates are classified in Heading 1806 (Chocolate and other food

preparations containing cocoa)

(ii) A bed linen set comprising a woven bedspread, pillow-cases and bolsters put up in a

paperboard case and it is classified in Heading 6304.

Rule 3(c): When goods cannot be classified by reference to 3(a) or 3(b), they shall be

classified under the heading which occurs last in numerical order among those which equally

merit consideration.

Examples:

(i) A belt made of 50% leather and 50% textiles is classified in Heading 6217.

(ii) A machine tool for working stone as well as wood is classified in Heading 8465.

Rule 4: Goods which cannot be classified in accordance with the above rules shall be

classified under the heading appropriate to the goods to which they are most akin.

Rule 5(a) This rule specifies the articles like 'cases’ suitable for long term use, which are

presented with the articles like medical instruments, gun cases, necklace cases and similar

containers, specially shaped or fitted to contain a specific article or set of articles and shall

be classified with such articles of a kind normally sold therewith. This rule does not,

however, apply to containers which give the whole its essential character.

Rule 5(b): This rule is subject to Rule 5(a) and governs the classification of packing materials

and packing containers of a kind normally used for packing the goods to which they relate.

However, this provision is not binding when such packing material or packing containers are

clearly suitable for repetitive use.

Rule 6: This rule provides that the classification of any products to its appropriate sub-

heading may be done only when the product concerned has already been properly classified

to its appropriate 4 digit heading. For the purposes of this rule relative Section and Chapter

notes also apply, unless the context otherwise requires.

Q-699: When incomplete goods presented before Customs for clearance and they have the

essential character of complete goods will be classified as

(i) Parts of goods

(ii) Complete goods

(iii) In-complete goods

(iv) None of the above

A-699: ii - Complete goods

176