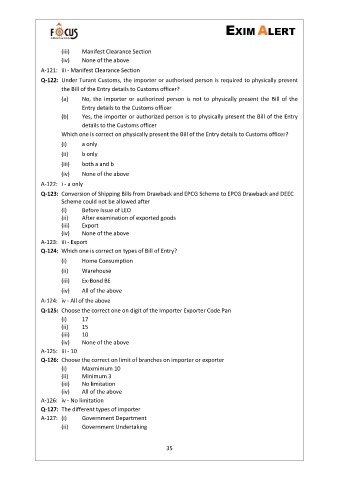

Page 40 - COMBINED QUESTIONS AND ANSWERS - EDITION 2019 - PART II_Neat

P. 40

(iii) Manifest Clearance Section

(iv) None of the above

A-121: iii - Manifest Clearance Section

Q-122: Under Turant Customs, the importer or authorised person is required to physically present

the Bill of the Entry details to Customs officer?

(a) No, the importer or authorized person is not to physically present the Bill of the

Entry details to the Customs officer

(b) Yes, the importer or authorized person is to physically present the Bill of the Entry

details to the Customs officer

Which one is correct on physically present the Bill of the Entry details to Customs officer?

(i) a only

(ii) b only

(iii) both a and b

(iv) None of the above

A-122: i - a only

Q-123: Conversion of Shipping Bills from Drawback and EPCG Scheme to EPCG Drawback and DEEC

Scheme could not be allowed after

(i) Before issue of LEO

(ii) After examination of exported goods

(iii) Export

(iv) None of the above

A-123: iii - Export

Q-124: Which one is correct on types of Bill of Entry?

(i) Home Consumption

(ii) Warehouse

(iii) Ex-Bond BE

(iv) All of the above

A-124: iv - All of the above

Q-125: Choose the correct one on digit of the Importer Exporter Code Pan

(i) 17

(ii) 15

(iii) 10

(iv) None of the above

A-125: iii - 10

Q-126: Choose the correct on limit of branches on importer or exporter

(i) Maxmimum 10

(ii) Minimum 3

(iii) No limitation

(iv) All of the above

A-126: iv - No limitation

Q-127: The different types of importer

A-127: (i) Government Department

(ii) Government Undertaking

35