Page 147 - A Canuck's Guide to Financial Literacy 2020

P. 147

147

Diversification

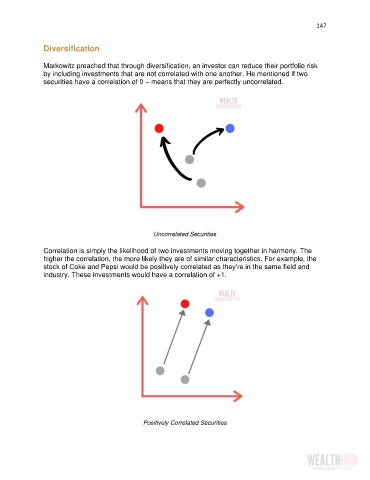

Markowitz preached that through diversification, an investor can reduce their portfolio risk

by including investments that are not correlated with one another. He mentioned if two

securities have a correlation of 0 – means that they are perfectly uncorrelated.

Uncorrelated Securities

Correlation is simply the likelihood of two investments moving together in harmony. The

higher the correlation, the more likely they are of similar characteristics. For example, the

stock of Coke and Pepsi would be positively correlated as they’re in the same field and

industry. These investments would have a correlation of +1.

Positively Correlated Securities