Page 149 - A Canuck's Guide to Financial Literacy 2020

P. 149

149

Capital Asset Pricing Model

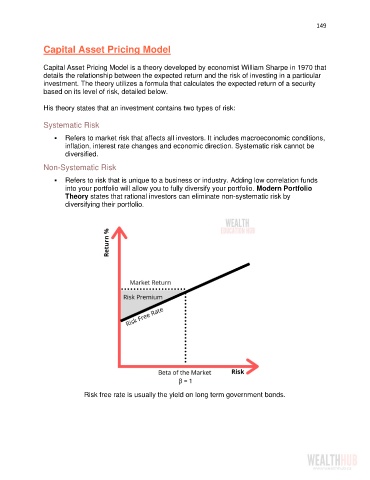

Capital Asset Pricing Model is a theory developed by economist William Sharpe in 1970 that

details the relationship between the expected return and the risk of investing in a particular

investment. The theory utilizes a formula that calculates the expected return of a security

based on its level of risk, detailed below.

His theory states that an investment contains two types of risk:

Systematic Risk

▪ Refers to market risk that affects all investors. It includes macroeconomic conditions,

inflation, interest rate changes and economic direction. Systematic risk cannot be

diversified.

Non-Systematic Risk

▪ Refers to risk that is unique to a business or industry. Adding low correlation funds

into your portfolio will allow you to fully diversify your portfolio. Modern Portfolio

Theory states that rational investors can eliminate non-systematic risk by

diversifying their portfolio.

Risk free rate is usually the yield on long term government bonds.