Page 11 - Webinar workbook

P. 11

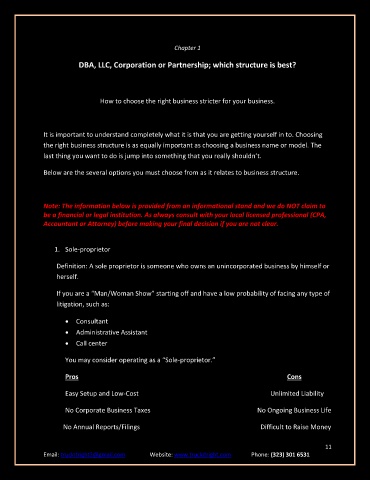

Chapter 1

DBA, LLC, Corporation or Partnership; which structure is best?

How to choose the right business stricter for your business.

It is important to understand completely what it is that you are getting yourself in to. Choosing

the right business structure is as equally important as choosing a business name or model. The

last thing you want to do is jump into something that you really shouldn’t.

Below are the several options you must choose from as it relates to business structure.

Note: The information below is provided from an informational stand and we do NOT claim to

be a financial or legal institution. As always consult with your local licensed professional (CPA,

Accountant or Attorney) before making your final decision if you are not clear.

1. Sole-proprietor

Definition: A sole proprietor is someone who owns an unincorporated business by himself or

herself.

If you are a “Man/Woman Show” starting off and have a low probability of facing any type of

litigation, such as:

• Consultant

• Administrative Assistant

• Call center

You may consider operating as a “Sole-proprietor.”

Pros Cons

Easy Setup and Low-Cost Unlimited Liability

No Corporate Business Taxes No Ongoing Business Life

No Annual Reports/Filings Difficult to Raise Money

11

Email: truckitright2@gmail.com Website: www.truckitright.com Phone: (323) 301 6531