Page 13 - Webinar workbook

P. 13

income taxes. This makes its structure less complex than that of a corporation, but like a

corporation, LLCs must offer stock.

Members share profits as they like. Members are considered self-employed and must pay

self-employment tax. When a member of the LLC leaves, the business is dissolved, and the

remaining members decide if they want to start a new business. An LLC is also formed

according to state law, through application to the secretary of state and filing articles of

incorporation. LLCs must also indicate in their names that they are an LLC or limited company.

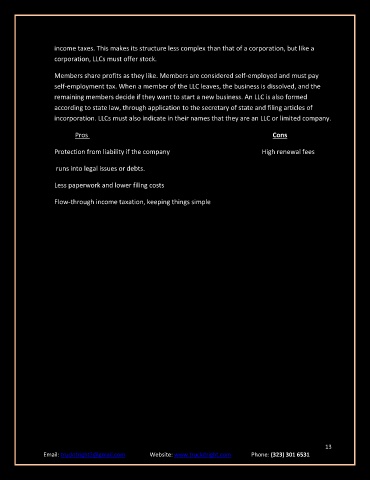

Pros Cons

Protection from liability if the company High renewal fees

runs into legal issues or debts.

Less paperwork and lower filing costs

Flow-through income taxation, keeping things simple

13

Email: truckitright2@gmail.com Website: www.truckitright.com Phone: (323) 301 6531