Page 23 - 2018 National Home Improvement

P. 23

2018 National Home Improvement Estimator, All Rights Reserved Page 17

Column 4, insurance and employer taxes in dollars, shows the hourly cost of taxes and insurance for

each construction trade. Insurance and taxes are paid on the costs in both columns 1 and 2.

Column 5, non-taxable fringe benefits, includes employer paid non-taxable benefits such as medical

coverage and tax-deferred pension and profit sharing plans. These fringe benefits average 4.86 percent of

the base wage for many construction contractors. The employer pays no taxes or insurance on these

benefits.

Column 6, the total hourly cost in dollars, is the sum of columns 1, 2, 4 and 5.

These hourly labor costs will apply within a few percent on many jobs. But wage rates may be much

higher or lower in the area where you do business. We recommend using your actual labor cost rather

than national averages. That's easy with the National Estimator program. When copying and pasting

any cost to your estimate, adjust the assumed hourly labor cost to your actual cost. You need do this

only once for each trade. And you can make this adjustment at any time. Any change you make is

applied to that trade throughout the estimate.

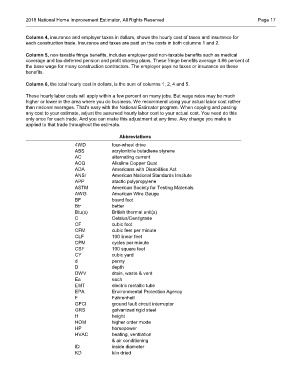

Abbreviations

4WD four-wheel drive

ABS acrylonitrile butadiene styrene

AC alternating current

ACQ Alkaline Copper Quat

ADA Americans with Disabilities Act

ANSI American National Standards Institute

APP atactic polypropylene

ASTM American Society for Testing Materials

AWG American Wire Gauge

BF board foot

Btr better

Btu(s) British thermal unit(s)

C Celsius/Centigrade

CF cubic foot

CFM cubic feet per minute

CLF 100 linear feet

CPM cycles per minute

CSF 100 square feet

CY cubic yard

d penny

D depth

DWV drain, waste & vent

Ea each

EMT electric metallic tube

EPA Environmental Protection Agency

F Fahrenheit

GFCI ground fault circuit interruptor

GRS galvanized rigid steel

H height

HOM higher order mode

HP horsepower

HVAC heating, ventilation

& air conditioning

ID inside diameter

KD kiln dried