Page 30 - ie2 August 2019

P. 30

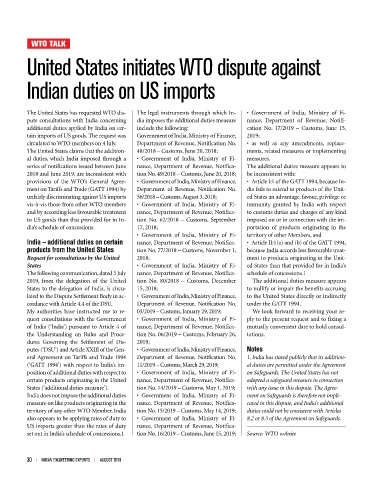

WTO TALK

United States initiates WTO dispute against

Indian duties on US imports

The United States has requested WTO dis- The legal instruments through which In- • Government of India, Ministry of Fi-

pute consultations with India concerning dia imposes the additional duties measure nance, Department of Revenue, Notifi-

additional duties applied by India on cer- include the following: cation No. 17/2019 – Customs, June 15,

tain imports of US goods. The request was Government of India, Ministry of Finance, 2019;

circulated to WTO members on 4 July. Department of Revenue, Notification No. • as well as any amendments, replace-

The United States claims that the addition- 48/2018 – Customs, June 20, 2018; ments, related measures or implementing

al duties, which India imposed through a • Government of India, Ministry of Fi- measures.

series of notifications issued between June nance, Department of Revenue, Notifica- The additional duties measure appears to

2018 and June 2019, are inconsistent with tion No. 49/2018 – Customs, June 20, 2018; be inconsistent with:

provisions of the WTO’s General Agree- • Government of India, Ministry of Finance, • Article I:1 of the GATT 1994, because In-

ment on Tariffs and Trade (GATT 1994) by Department of Revenue, Notification No. dia fails to extend to products of the Unit-

unfairly discriminating against US imports 56/2018 – Customs, August 3, 2018; ed States an advantage, favour, privilege or

vis-à-vis those from other WTO members • Government of India, Ministry of Fi- immunity granted by India with respect

and by according less favourable treatment nance, Department of Revenue, Notifica- to customs duties and charges of any kind

to US goods than that provided for in In- tion No. 62/2018 – Customs, September imposed on or in connection with the im-

dia’s schedule of concessions. 17, 2018; portation of products originating in the

• Government of India, Ministry of Fi- territory of other Members, and

India – additional duties on certain nance, Department of Revenue, Notifica- • Article II:1(a) and (b) of the GATT 1994,

products from the United States tion No. 77/2018 – Customs, November 1, because India accords less favourable treat-

Request for consultations by the United 2018; ment to products originating in the Unit-

States • Government of India, Ministry of Fi- ed States than that provided for in India’s

The following communication, dated 3 July nance, Department of Revenue, Notifica- schedule of concessions.1

2019, from the delegation of the United tion No. 80/2018 – Customs, December The additional duties measure appears

States to the delegation of India, is circu- 15, 2018; to nullify or impair the benefits accruing

lated to the Dispute Settlement Body in ac- • Government of India, Ministry of Finance, to the United States directly or indirectly

cordance with Article 4.4 of the DSU. Department of Revenue, Notification No. under the GATT 1994.

My authorities have instructed me to re- 03/2019 – Customs, January 29, 2019; We look forward to receiving your re-

quest consultations with the Government • Government of India, Ministry of Fi- ply to the present request and to fixing a

of India (‘India’) pursuant to Article 4 of nance, Department of Revenue, Notifica- mutually convenient date to hold consul-

the Understanding on Rules and Proce- tion No. 06/2019 – Customs, February 26, tations.

dures Governing the Settlement of Dis- 2019;

putes (‘DSU’) and Article XXIII of the Gen- • Government of India, Ministry of Finance, Notes

eral Agreement on Tariffs and Trade 1994 Department of Revenue, Notification No. 1. India has stated publicly that its addition-

(‘GATT 1994’) with respect to India’s im- 11/2019 – Customs, March 29, 2019; al duties are permitted under the Agreement

position of additional duties with respect to • Government of India, Ministry of Fi- on Safeguards. The United States has not

certain products originating in the United nance, Department of Revenue, Notifica- adopted a safeguard measure in connection

States (‘additional duties measure’). tion No. 14/2019 – Customs, May 1, 2019; with any issue in this dispute. The Agree-

India does not impose the additional duties • Government of India, Ministry of Fi- ment on Safeguards is therefore not impli-

measure on like products originating in the nance, Department of Revenue, Notifica- cated in this dispute, and India’s additional

territory of any other WTO Member. India tion No. 15/2019 – Customs, May 14, 2019; duties could not be consistent with Articles

also appears to be applying rates of duty to • Government of India, Ministry of Fi- 8.2 or 8.3 of the Agreement on Safeguards.

US imports greater than the rates of duty nance, Department of Revenue, Notifica-

set out in India’s schedule of concessions.1 tion No. 16/2019 – Customs, June 15, 2019; Source: WTO website

30 l INDIAN ENGINEERING EXPORTS l AUGUST 2019