Page 33 - ie2 August 2019

P. 33

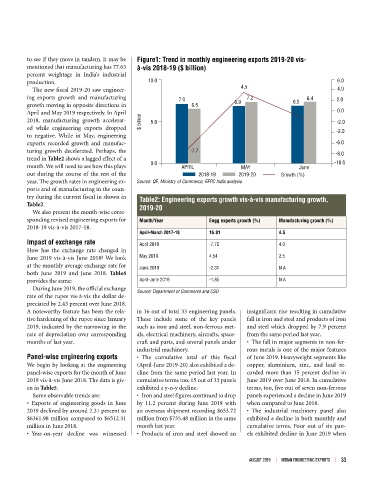

to see if they move in tandem. It may be Figure1: Trend in monthly engineering exports 2019-20 vis-

mentioned that manufacturing has 77.63 à-vis 2018-19 ($ billion)

percent weightage in India’s industrial

production. 10.0 6.0

The new fiscal 2019-20 saw engineer- 4.5 4.0

ing exports growth and manufacturing 7.0 7.2 6.4 2.0

growth moving in opposite directions in 6.5 6.9 6.5

April and May 2019 respectively. In April 0.0

2018, manufacturing growth accelerat- $ billion 5.0 -2.0

ed while engineering exports dropped -2.0

to negative. While in May, engineering

exports recorded growth and manufac- -6.0

turing growth decelerated. Perhaps, the -7.7 -8.0

trend in Table2 shows a lagged effect of a -10.0

month. We will need to see how this plays 0.0 APRIL MAY June

out during the course of the rest of the 2018-19 2019-20 Growth (%)

year. The growth rates in engineering ex- Source: QE, Ministry of Commerce; EEPC India analysis

ports and of manufacturing in the coun-

try during the current fiscal in shown in Table2: Engineering exports growth vis-à-vis manufacturing growth,

Table2. 2019-20

We also present the month-wise corre-

sponding revised engineering exports for Month/Year Engg exports growth (%) Manufacturing growth (%)

2018-19 vis-à-vis 2017-18.

April-March 2017-18 16.81 4.5

Impact of exchange rate April 2019 -7.72 4.0

How has the exchange rate changed in

June 2019 vis-à-vis June 2018? We look May 2018 4.54 2.5

at the monthly average exchange rate for June 2019 -2.31 N A

both June 2019 and June 2018. Table4

provides the same: April-June 2019 -1.85 N A

During June 2019, the official exchange Source: Department of Commerce and CSO

rate of the rupee vis-à-vis the dollar de-

preciated by 2.43 percent over June 2018.

A noteworthy feature has been the rela- in 16 out of total 33 engineering panels. insignificant rise resulting in cumulative

tive hardening of the rupee since January These include some of the key panels fall in iron and steel and products of iron

2019, indicated by the narrowing in the such as iron and steel, non-ferrous met- and steel which dropped by 7.9 percent

rate of depreciation over corresponding als, electrical machinery, aircrafts, space- from the same period last year.

months of last year. craft and parts, and several panels under • The fall in major segments in non-fer-

industrial machinery. rous metals is one of the major features

Panel-wise engineering exports • The cumulative total of this fiscal of June 2019. Heavyweight segments like

We begin by looking at the engineering (April-June 2019-20) also exhibited a de- copper, aluminium, zinc, and lead re-

panel-wise exports for the month of June cline from the same period last year. In corded more than 15 percent decline in

2019 vis-à-vis June 2018. The data is giv- cumulative terms too, 15 out of 33 panels June 2019 over June 2018. In cumulative

en in Table5. exhibited a y-o-y decline. terms, too, five out of seven non-ferrous

Some observable trends are: • Iron and steel figures continued to drop panels experienced a decline in June 2019

• Exports of engineering goods in June by 11.2 percent during June 2019 with when compared to June 2018.

2019 declined by around 2.31 percent to an overseas shipment recording $653.72 • The industrial machinery panel also

$6361.98 million compared to $6512.31 million from $735.48 million in the same exhibited a decline in both monthly and

million in June 2018. month last year. cumulative terms. Four out of six pan-

• Year-on-year decline was witnessed • Products of iron and steel showed an els exhibited decline in June 2019 when

AUGUST 2019 l INDIAN ENGINEERING EXPORTS l 33