Page 80 - VIRANSH COACHING CLASSES

P. 80

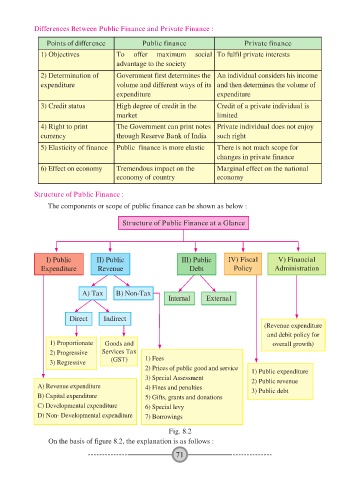

Differences Between Public Finance and Private Finance :

Points of difference Public finance Private finance

1) Objectives To offer maximum social To fulfil private interests

advantage to the society

2) Determination of Government first determines the An individual considers his income

expenditure volume and different ways of its and then determines the volume of

expenditure expenditure

3) Credit status High degree of credit in the Credit of a private individual is

market limited

4) Right to print The Government can print notes Private individual does not enjoy

currency through Reserve Bank of India such right

5) Elasticity of finance Public finance is more elastic There is not much scope for

changes in private finance

6) Effect on economy Tremendous impact on the Marginal effect on the national

economy of country economy

Structure of Public Finance :

The components or scope of public finance can be shown as below :

Structure of Public Finance at a Glance

I) Public II) Public III) Public IV) Fiscal V) Financial

Expenditure Revenue Debt Policy Administration

A) Tax B) Non-Tax

Internal External

Direct Indirect

(Revenue expenditure

and debit policy for

1) Proportionate Goods and overall growth)

2) Progressive Services Tax

3) Regressive (GST) 1) Fees

2) Prices of public good and service 1) Public expenditure

3) Special Assessment 2) Public revenue

A) Revenue expenditure 4) Fines and penalties 3) Public debt

B) Capital expenditure 5) Gifts, grants and donations

C) Developmental expenditure 6) Special levy

D) Non- Developmental expenditure 7) Borrowings

Fig. 8.2

On the basis of figure 8.2, the explanation is as follows :

71