Page 142 - VIRANSH COACHING CLASSES

P. 142

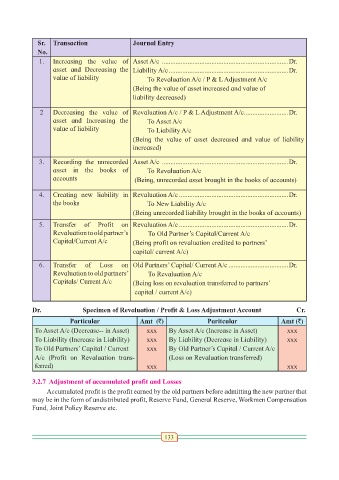

Sr. Transaction Journal Entry

No.

1. Increasing the value of Asset A/c ..........................................................................Dr.

asset and Decreasing the Liability A/c ......................................................................Dr.

value of liability To Revaluation A/c / P & L Adjustment A/c

(Being the value of asset increased and value of

liability decreased)

2 Decreasing the value of Revaluation A/c / P & L Adjustment A/c ..........................Dr.

asset and Increasing the To Asset A/c

value of liability To Liability A/c

(Being the value of asset decreased and value of liability

increased)

3. Recording the unrecorded Asset A/c ..........................................................................Dr.

asset in the books of To Revaluation A/c

accounts (Being, unrecorded asset brought in the books of accounts)

4. Creating new liability in Revaluation A/c ................................................................Dr.

the books To New Liability A/c

(Being unrecorded liability brought in the books of accounts)

5. Transfer of Profit on Revaluation A/c ................................................................Dr.

Revaluation to old partner’s To Old Partner’s Capital/Current A/c

Capital/Current A/c (Being profit on revaluation credited to partners’

capital/ current A/c)

6. Transfer of Loss on Old Partners’ Capital/ Current A/c ...................................Dr.

Revaluation to old partners’ To Revaluation A/c

Capitals/ Current A/c (Being loss on revaluation transferred to partners’

capital / current A/c)

Dr. Specimen of Revaluation / Profit & Loss Adjustment Account Cr.

Particular Amt (`) Paritcular Amt (`)

To Asset A/c (Decrease-- in Asset) xxx By Asset A/c (Increase in Asset) xxx

To Liability (Increase in Liability) xxx By Liability (Decrease in Liability) xxx

To Old Partners’ Capital / Current xxx By Old Partner’s Capital / Current A/c

A/c (Profit on Revaluation trans- (Loss on Revaluation transferred)

ferred) xxx xxx

3.2.7 Adjustment of accumulated profit and Losses

Accumulated profit is the profit earned by the old partners before admitting the new partner that

may be in the form of undistributed profit, Reserve Fund, General Reserve, Workmen Compensation

Fund, Joint Policy Reserve etc.

133