Page 147 - VIRANSH COACHING CLASSES

P. 147

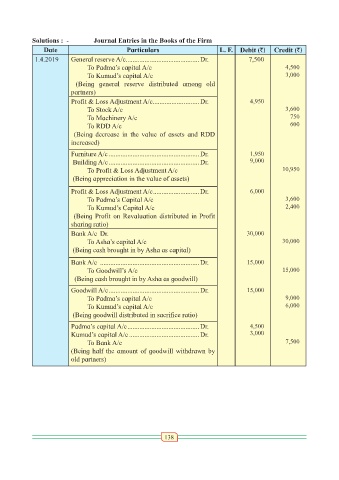

Solutions : - Journal Entries in the Books of the Firm

Date Particulars L. F. Debit (`) Credit (`)

1.4.2019 General reserve A/c ...........................................Dr. 7,500

To Padma’s capital A/c 4,500

To Kumud’s capital A/c 3,000

(Being general reserve distributed among old

partners)

Profit & Loss Adjustment A/c.................. .........Dr. 4,950

To Stock A/c 3,600

To Machinery A/c 750

To RDD A/c 600

(Being decrease in the value of assets and RDD

increased)

Furniture A/c .....................................................Dr. 1,950

Building A/c .....................................................Dr. 9,000

To Profit & Loss Adjustment A/c 10,950

(Being appreciation in the value of assets)

Profit & Loss Adjustment A/c ...........................Dr. 6,000

To Padma’s Capital A/c 3,600

To Kumud’s Capital A/c 2,400

(Being Profit on Revaluation distributed in Profit

sharing ratio)

Bank A/c Dr. 30,000

To Asha’s capital A/c 30,000

(Being cash brought in by Asha as capital)

Bank A/c ..........................................................Dr. 15,000

To Goodwill’s A/c 15,000

(Being cash brought in by Asha as goodwill)

Goodwill A/c .....................................................Dr. 15,000

To Padma’s capital A/c 9,000

To Kumud’s capital A/c 6,000

(Being goodwill distributed in sacrifice ratio)

Padma’s capital A/c ..........................................Dr. 4,500

Kumud’s capital A/c .........................................Dr. 3,000

To Bank A/c 7,500

(Being half the amount of goodwill withdrawn by

old partners)

138