Page 150 - VIRANSH COACHING CLASSES

P. 150

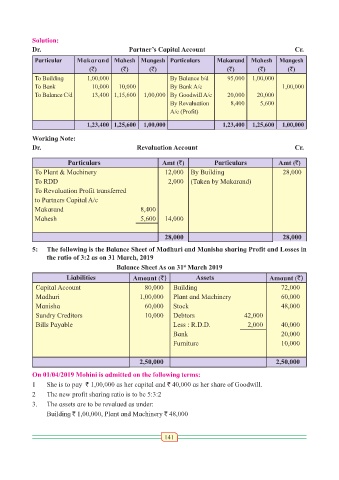

Solution:

Dr. Partner’s Capital Account Cr.

Particular Makarand Mahesh Mangesh Particulars Makarand Mahesh Mangesh

(`) (`) (`) (`) (`) (`)

To Building 1,00,000 By Balance b/d 95,000 1,00,000

To Bank 10,000 10,000 By Bank A/c 1,00,000

To Balance C/d 13,400 1,15,600 1,00,000 By Goodwill A/c 20,000 20,000

By Revaluation 8,400 5,600

A/c (Profit)

1,23,400 1,25,600 1,00,000 1,23,400 1,25,600 1,00,000

Working Note:

Dr. Revaluation Account Cr.

Particulars Amt (`) Particulars Amt (`)

To Plant & Machinery 12,000 By Building 28,000

To RDD 2,000 (Taken by Makarand)

To Revaluation Profit transferred

to Partners Capital A/c

Makarand 8,400

Mahesh 5,600 14,000

28,000 28,000

5: The following is the Balance Sheet of Madhuri and Manisha sharing Profit and Losses in

the ratio of 3:2 as on 31 March, 2019

Balance Sheet As on 31 March 2019

st

Liabilities Amount (`) Assets Amount (`)

Capital Account 80,000 Building 72,000

Madhuri 1,00,000 Plant and Machinery 60,000

Manisha 60,000 Stock 48,000

Sundry Creditors 10,000 Debtors 42,000

Bills Payable Less : R.D.D. 2,000 40,000

Bank 20,000

Furniture 10,000

2,50,000 2,50,000

On 01/04/2019 Mohini is admitted on the following terms:

1 She is to pay ` 1,00,000 as her capital and ` 40,000 as her share of Goodwill.

2 The new profit sharing ratio is to be 5:3:2

3. The assets are to be revalued as under:

Building ` 1,00,000, Plant and Machinery ` 48,000

141