Page 149 - VIRANSH COACHING CLASSES

P. 149

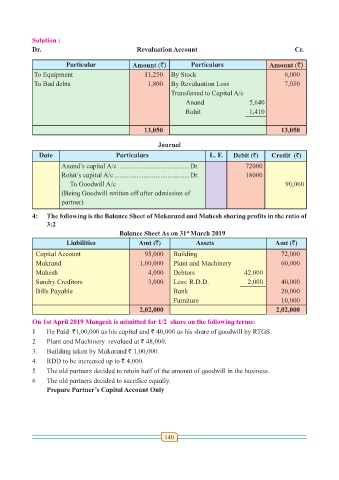

Solution :

Dr. Revaluation Account Cr.

Particular Amount (`) Particulars Amount (`)

To Equipment 11,250 By Stock 6,000

To Bad debts 1,800 By Revaluation Loss 7,050

Transferred to Capital A/c

Anand 5,640

Rohit 1,410

13,050 13,050

Journal

Date Particulars L. F. Debit (`) Credit (`)

Anand’s capital A/c ..........................................Dr. 72000

Rohit’s capital A/c ............................................Dr. 18000

To Goodwill A/c 90,000

(Being Goodwill written off after admission of

partner)

4: The following is the Balance Sheet of Makarand and Mahesh sharing profits in the ratio of

3:2

Balance Sheet As on 31 March 2019

st

Liabilities Amt (`) Assets Amt (`)

Capital Account 95,000 Building 72,000

Makrand 1,00,000 Plant and Machinery 60,000

Mahesh 4,000 Debtors 42,000

Sundry Creditors 3,000 Less: R.D.D. 2,000 40,000

Bills Payable Bank 20,000

Furniture 10,000

2,02,000 2,02,000

On 1st April 2019 Mangesh is admitted for 1/2 share on the following terms:

1 He Paid `1,00,000 as his capital and ` 40,000 as his share of goodwill by RTGS.

2 Plant and Machinery revalued at ` 48,000.

3. Building taken by Makarand ` 1,00,000.

4. RDD to be increased up to ` 4,000.

5 The old partners decided to retain half of the amount of goodwill in the business.

6 The old partners decided to sacrifice equally.

Prepare Partner’s Capital Account Only

140