Page 148 - VIRANSH COACHING CLASSES

P. 148

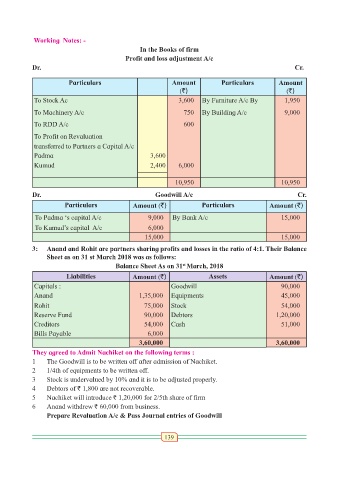

Working Notes: -

In the Books of firm

Profit and loss adjustment A/c

Dr. Cr.

Particulars Amount Particulars Amount

(`) (`)

To Stock Ac 3,600 By Furniture A/c By 1,950

To Machinery A/c 750 By Building A/c 9,000

To RDD A/c 600

To Profit on Revaluation

transferred to Partners a Capital A/c

Padma 3,600

Kumud 2,400 6,000

10,950 10,950

Dr. Goodwill A/c Cr.

Particulars Amount (`) Particulars Amount (`)

To Padma ‘s capital A/c 9,000 By Bank A/c 15,000

To Kumud’s capital A/c 6,000

15,000 15,000

3: Anand and Rohit are partners sharing profits and losses in the ratio of 4:1. Their Balance

Sheet as on 31 st March 2018 was as follows:

Balance Sheet As on 31 March, 2018

st

Liabilities Amount (`) Assets Amount (`)

Capitals : Goodwill 90,000

Anand 1,35,000 Equipments 45,000

Rohit 75,000 Stock 54,000

Reserve Fund 90,000 Debtors 1,20,000

Creditors 54,000 Cash 51,000

Bills Payable 6,000

3,60,000 3,60,000

They agreed to Admit Nachiket on the following terms :

1 The Goodwill is to be written off after admission of Nachiket.

2 1/4th of equipments to be written off.

3 Stock is undervalued by 10% and it is to be adjusted properly.

4 Debtors of ` 1,800 are not recoverable.

5 Nachiket will introduce ` 1,20,000 for 2/5th share of firm

6 Anand withdrew ` 60,000 from business.

Prepare Revaluation A/c & Pass Journal entries of Goodwill

139