Page 155 - VIRANSH COACHING CLASSES

P. 155

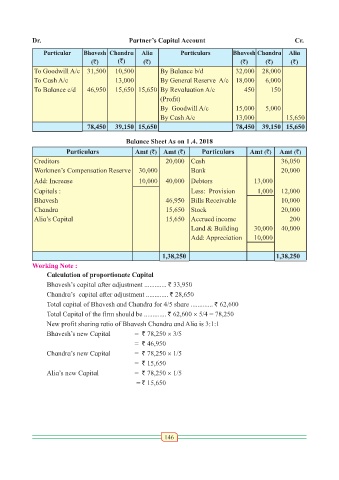

Dr. Partner’s Capital Account Cr.

Particular Bhavesh Chandra Alia Particulars Bhavesh Chandra Alia

(`) (`) (`) (`) (`) (`)

To Goodwill A/c 31,500 10,500 By Balance b/d 32,000 28,000

To Cash A/c 13,000 By General Reserve A/c 18,000 6,000

To Balance c/d 46,950 15,650 15,650 By Revaluation A/c 450 150

(Profit)

By Goodwill A/c 15,000 5,000

By Cash A/c 13,000 15,650

78,450 39,150 15,650 78,450 39,150 15,650

Balance Sheet As on 1.4. 2018

Particulars Amt (`) Amt (`) Particulars Amt (`) Amt (`)

Creditors 20,000 Cash 36,050

Workmen’s Compensation Reserve 30,000 Bank 20,000

Add: Increase 10,000 40,000 Debtors 13,000

Capitals : Less: Provision 1,000 12,000

Bhavesh 46,950 Bills Receivable 10,000

Chandra 15,650 Stock 20,000

Alia’s Capital 15,650 Accrued income 200

Land & Building 30,000 40,000

Add: Appreciation 10,000

1,38,250 1,38,250

Working Note :

Calculation of proportionate Capital

Bhavesh’s capital after adjustment ............. ` 33,950

Chandra’s capital after adjustment ............. ` 28,650

Total capital of Bhavesh and Chandra for 4/5 share ............. ` 62,600

Total Capital of the firm should be ............. ` 62,600 × 5/4 = 78,250

New profit sharing ratio of Bhavesh Chandra and Alia is 3:1:1

Bhavesh’s new Capital = ` 78,250 × 3/5

= ` 46,950

Chandra’s new Capital = ` 78,250 × 1/5

= ` 15,650

Alia’s new Capital = ` 78,250 × 1/5

= ` 15,650

146