Page 157 - VIRANSH COACHING CLASSES

P. 157

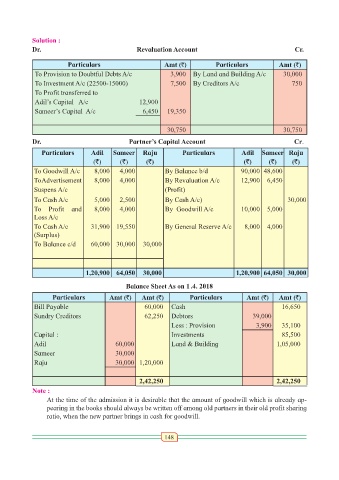

Solution :

Dr. Revaluation Account Cr.

Particulars Amt (`) Particulars Amt (`)

To Provision to Doubtful Debts A/c 3,900 By Land and Building A/c 30,000

To Investment A/c (22500-15000) 7,500 By Creditors A/c 750

To Profit transferred to

Adil’s Capital A/c 12,900

Sameer’s Capital A/c 6,450 19,350

30,750 30,750

Dr. Partner’s Capital Account Cr.

Particulars Adil Sameer Raju Particulars Adil Sameer Raju

(`) (`) (`) (`) (`) (`)

To Goodwill A/c 8,000 4,000 By Balance b/d 90,000 48,600

To Advertisement 8,000 4,000 By Revaluation A/c 12,900 6,450

Suspens A/c (Profit)

To Cash A/c 5,000 2,500 By Cash A/c) 30,000

To Profit and 8,000 4,000 By Goodwill A/c 10,000 5,000

Loss A/c

To Cash A/c 31,900 19,550 By General Reserve A/c 8,000 4,000

(Surplus)

To Balance c/d 60,000 30,000 30,000

1,20,900 64,050 30,000 1,20,900 64,050 30,000

Balance Sheet As on 1.4. 2018

Particulars Amt (`) Amt (`) Particulars Amt (`) Amt (`)

Bill Payable 60,000 Cash 16,650

Sundry Creditors 62,250 Debtors 39,000

Less : Provision 3,900 35,100

Capital : Investments 85,500

Adil 60,000 Land & Building 1,05,000

Sameer 30,000

Raju 30,000 1,20,000

2,42,250 2,42,250

Note :

At the time of the admission it is desirable that the amount of goodwill which is already ap-

pearing in the books should always be written off among old partners in their old profit sharing

ratio, when the new partner brings in cash for goodwill.

148