Page 156 - VIRANSH COACHING CLASSES

P. 156

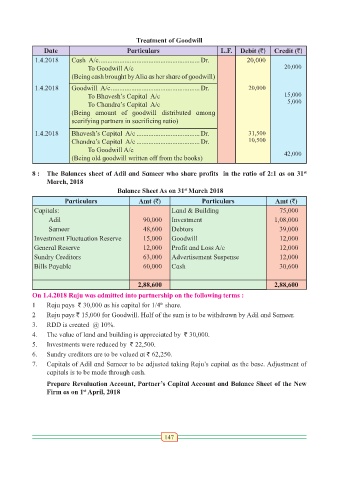

Treatment of Goodwill

Date Particulars L.F. Debit (`) Credit (`)

1.4.2018 Cash A/c ...........................................................Dr. 20,000

To Goodwill A/c 20,000

(Being cash brought by Alia as her share of goodwill)

1.4.2018 Goodwill A/c ....................................................Dr. 20,000

To Bhavesh’s Capital A/c 15,000

To Chandra’s Capital A/c 5,000

(Being amount of goodwill distributed among

scarifying partners in sacrificing ratio)

1.4.2018 Bhavesh’s Capital A/c .....................................Dr. 31,500

Chandra’s Capital A/c .....................................Dr. 10,500

To Goodwill A/c 42,000

(Being old goodwill written off from the books)

8 : The Balances sheet of Adil and Sameer who share profits in the ratio of 2:1 as on 31

st

March, 2018

st

Balance Sheet As on 31 March 2018

Particulars Amt (`) Particulars Amt (`)

Capitals: Land & Building 75,000

Adil 90,000 Investment 1,08,000

Sameer 48,600 Debtors 39,000

Investment Fluctuation Reserve 15,000 Goodwill 12,000

General Reserve 12,000 Profit and Loss A/c 12,000

Sundry Creditors 63,000 Advertisement Suspense 12,000

Bills Payable 60,000 Cash 30,600

2,88,600 2,88,600

On 1.4.2018 Raju was admitted into partnership on the following terms :

1 Raju pays ` 30,000 as his capital for 1/4 share.

th

2 Raju pays ` 15,000 for Goodwill. Half of the sum is to be withdrawn by Adil and Sameer.

3. RDD is created @ 10%.

4. The value of land and building is appreciated by ` 30,000.

5. Investments were reduced by ` 22,500.

6. Sundry creditors are to be valued at ` 62,250.

7. Capitals of Adil and Sameer to be adjusted taking Raju’s capital as the base. Adjustment of

capitals is to be made through cash.

Prepare Revaluation Account, Partner’s Capital Account and Balance Sheet of the New

st

Firm as on 1 April, 2018

147