Page 160 - VIRANSH COACHING CLASSES

P. 160

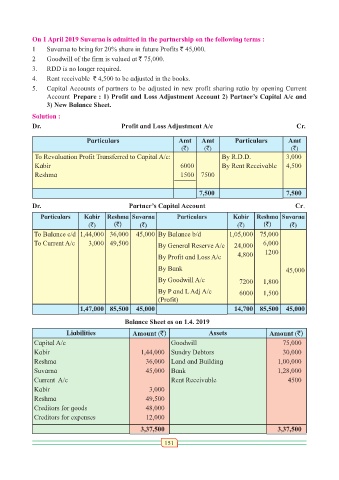

On 1 April 2019 Suvarna is admitted in the partnership on the following terms :

1 Suvarna to bring for 20% share in future Profits ` 45,000.

2 Goodwill of the firm is valued at ` 75,000.

3. RDD is no longer required.

4. Rent receivable ` 4,500 to be adjusted in the books.

5. Capital Accounts of partners to be adjusted in new profit sharing ratio by opening Current

Account Prepare : 1) Profit and Loss Adjustment Account 2) Partner’s Capital A/c and

3) New Balance Sheet.

Solution :

Dr. Profit and Loss Adjustment A/c Cr.

Particulars Amt Amt Particulars Amt

(`) (`) (`)

To Revaluation Profit Transferred to Capital A/c: By R.D.D. 3,000

Kabir 6000 By Rent Receivable 4,500

Reshma 1500 7500

7,500 7,500

Dr. Partner’s Capital Account Cr.

Particulars Kabir Reshma Suvarna Particulars Kabir Reshma Suvarna

(`) (`) (`) (`) (`) (`)

To Balance c/d 1,44,000 36,000 45,000 By Balance b/d 1,05,000 75,000

To Current A/c 3,000 49,500 By General Reserve A/c 24,000 6,000

By Profit and Loss A/c 4,800 1200

By Bank 45,000

By Goodwill A/c 7200 1,800

By P and L Adj A/c 6000 1,500

(Profit)

1,47,000 85,500 45,000 14,700 85,500 45,000

Balance Sheet as on 1.4. 2019

Liabilities Amount (`) Assets Amount (`)

Capital A/c Goodwill 75,000

Kabir 1,44,000 Sundry Debtors 30,000

Reshma 36,000 Land and Building 1,00,000

Suvarna 45,000 Bank 1,28,000

Current A/c Rent Receivable 4500

Kabir 3,000

Reshma 49,500

Creditors for goods 48,000

Creditors for expenses 12,000

3,37,500 3,37,500

151