Page 163 - VIRANSH COACHING CLASSES

P. 163

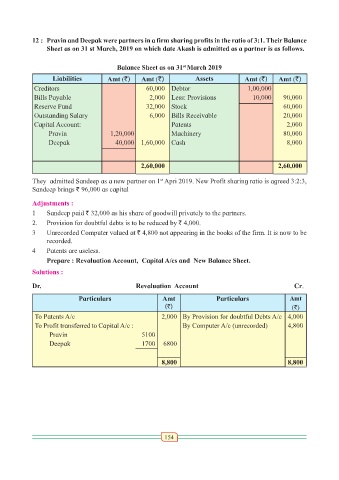

12 : Pravin and Deepak were partners in a firm sharing profits in the ratio of 3:1. Their Balance

Sheet as on 31 st March, 2019 on which date Akash is admitted as a partner is as follows.

st

Balance Sheet as on 31 March 2019

Liabilities Amt (`) Amt (`) Assets Amt (`) Amt (`)

Creditors 60,000 Debtor 1,00,000

Bills Payable 2,000 Less: Provisions 10,000 90,000

Reserve Fund 32,000 Stock 60,000

Outstanding Salary 6,000 Bills Receivable 20,000

Capital Account: Patents 2,000

Pravin 1,20,000 Machinery 80,000

Deepak 40,000 1,60,000 Cash 8,000

2,60,000 2,60,000

st

They admitted Sandeep as a new partner on 1 Apri 2019. New Profit sharing ratio is agreed 3:2:3,

Sandeep brings ` 96,000 as capital

Adjustments :

1 Sandeep paid ` 32,000 as his share of goodwill privately to the partners.

2. Provision for doubtful debts is to be reduced by ` 4,000.

3 Unrecorded Computer valued at ` 4,800 not appearing in the books of the firm. It is now to be

recorded.

4 Patents are useless.

Prepare : Revaluation Account, Capital A/cs and New Balance Sheet.

Solutions :

Dr. Revaluation Account Cr.

Particulars Amt Particulars Amt

(`) (`)

To Patents A/c 2,000 By Provision for doubtful Debts A/c 4,000

To Profit transferred to Capital A/c : By Computer A/c (unrecorded) 4,800

Pravin 5100

Deepak 1700 6800

8,800 8,800

154