Page 167 - VIRANSH COACHING CLASSES

P. 167

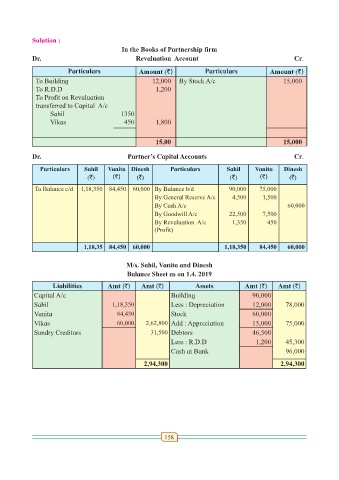

Solution :

In the Books of Partnership firm

Dr. Revaluation Account Cr.

Particulars Amount (`) Particulars Amount (`)

To Building 12,000 By Stock A/c 15,000

To R.D.D 1,200

To Profit on Revaluation

transferred to Capital A/c

Sahil 1350

Vikas 450 1,800

15,00 15,000

Dr. Partner’s Capital Accounts Cr.

Particulars Sahil Vanita Dinesh Particulars Sahil Vanita Dinesh

(`) (`) (`) (`) (`) (`)

To Balance c/d 1,18,350 84,450 60,000 By Balance b/d 90,000 75,000

By General Reserve A/c 4,500 1,500

By Cash A/c 60,000

By Goodwill A/c 22,500 7,500

By Revaluation A/c 1,350 450

(Profit)

1,18,35 84,450 60,000 1,18,350 84,450 60,000

M/s. Sahil, Vanita and Dinesh

Balance Sheet as on 1.4. 2019

Liabilities Amt (`) Amt (`) Assets Amt (`) Amt (`)

Capital A/c Building 90,000

Sahil 1,18,350 Less : Depreciation 12,000 78,000

Vanita 84,450 Stock 60,000

Vikas 60,000 2,62,800 Add : Appreciation 15,000 75,000

Sundry Creditors 31,500 Debtors 46,500

Less : R.D.D 1,200 45,300

Cash at Bank 96,000

2,94,300 2,94,300

158