Page 271 - VIRANSH COACHING CLASSES

P. 271

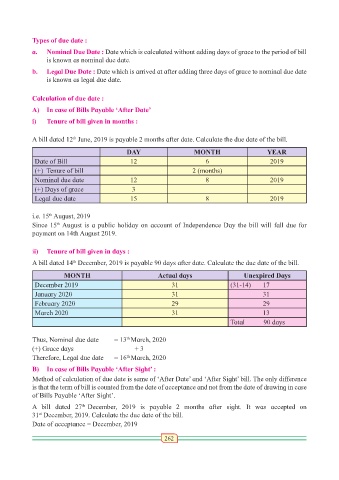

Types of due date :

a. Nominal Due Date : Date which is calculated without adding days of grace to the period of bill

is known as nominal due date.

b. Legal Due Date : Date which is arrived at after adding three days of grace to nominal due date

is known as legal due date.

Calculation of due date :

A) In case of Bills Payable ‘After Date’

i) Tenure of bill given in months :

A bill dated 12 June, 2019 is payable 2 months after date. Calculate the due date of the bill.

th

DAY MONTH YEAR

Date of Bill 12 6 2019

(+) Tenure of bill 2 (months)

Nominal due date 12 8 2019

(+) Days of grace 3

Legal due date 15 8 2019

i.e. 15 August, 2019

th

Since 15 August is a public holiday on account of Independence Day the bill will fall due for

th

payment on 14th August 2019.

ii) Tenure of bill given in days :

A bill dated 14 December, 2019 is payable 90 days after date. Calculate the due date of the bill.

th

MONTH Actual days Unexpired Days

December 2019 31 (31-14) 17

January 2020 31 31

February 2020 29 29

March 2020 31 13

Total 90 days

th

Thus, Nominal due date = 13 March, 2020

(+) Grace days + 3

Therefore, Legal due date = 16 March, 2020

th

B) In case of Bills Payable ‘After Sight’ :

Method of calculation of due date is same of ‘After Date’ and ‘After Sight’ bill. The only difference

is that the term of bill is counted from the date of acceptance and not from the date of drawing in case

of Bills Payable ‘After Sight’.

A bill dated 27 December, 2019 is payable 2 months after sight. It was accepted on

th

31 December, 2019. Calculate the due date of the bill.

st

Date of acceptance = December, 2019

262