Page 387 - VIRANSH COACHING CLASSES

P. 387

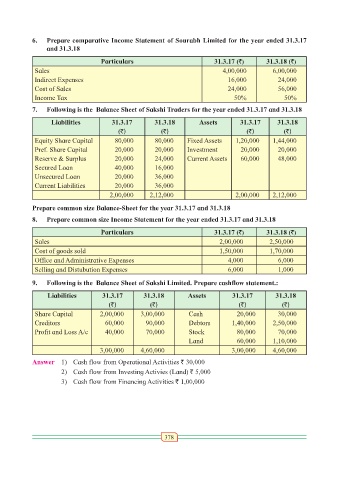

6. Prepare comparative Income Statement of Sourabh Limited for the year ended 31.3.17

and 31.3.18

Particulars 31.3.17 (`) 31.3.18 (`)

Sales 4,00,000 6,00,000

Indirect Expenses 16,000 24,000

Cost of Sales 24,000 56,000

Income Tax 50% 50%

7. Following is the Balance Sheet of Sakshi Traders for the year ended 31.3.17 and 31.3.18

Liabilities 31.3.17 31.3.18 Assets 31.3.17 31.3.18

(`) (`) (`) (`)

Equity Share Capital 80,000 80,000 Fixed Assets 1,20,000 1,44,000

Pref. Share Capital 20,000 20,000 Investment 20,000 20,000

Reserve & Surplus 20,000 24,000 Current Assets 60,000 48,000

Secured Loan 40,000 16,000

Unsecured Loan 20,000 36,000

Current Liabilities 20,000 36,000

2,00,000 2,12,000 2,00,000 2,12,000

Prepare common size Balance-Sheet for the year 31.3.17 and 31.3.18

8. Prepare common size Income Statement for the year ended 31.3.17 and 31.3.18

Particulars 31.3.17 (`) 31.3.18 (`)

Sales 2,00,000 2,50,000

Cost of goods sold 1,50,000 1,70,000

Office and Administrative Expenses 4,000 6,000

Selling and Distubution Expenses 6,000 1,000

9. Following is the Balance Sheet of Sakshi Limited. Prepare cashflow statement.:

Liabilities 31.3.17 31.3.18 Assets 31.3.17 31.3.18

(`) (`) (`) (`)

Share Capital 2,00,000 3,00,000 Cash 20,000 30,000

Creditors 60,000 90,000 Debtors 1,40,000 2,50,000

Profit and Loss A/c 40,000 70,000 Stock 80,000 70,000

Land 60,000 1,10,000

3,00,000 4,60,000 3,00,000 4,60,000

Answer 1) Cash flow from Operational Activities ` 30,000

2) Cash flow from Investing Activies (Land) ` 5,000

3) Cash flow from Financing Activities ` 1,00,000

378