Page 382 - VIRANSH COACHING CLASSES

P. 382

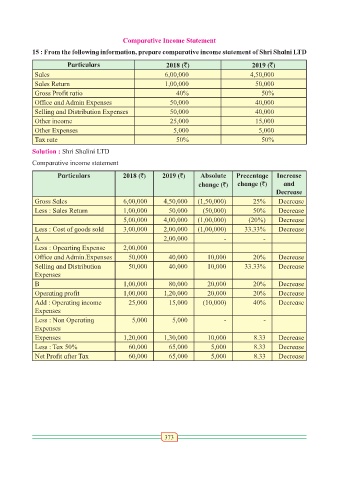

Comparative Income Statement

15 : From the following information, prepare comparative income statement of Shri Shalni LTD

Particulars 2018 (`) 2019 (`)

Sales 6,00,000 4,50,000

Sales Return 1,00,000 50,000

Gross Profit ratio 40% 50%

Office and Admin Expenses 50,000 40,000

Selling and Distribution Expenses 50,000 40,000

Other income 25,000 15,000

Other Expenses 5,000 5,000

Tax rate 50% 50%

Solution : Shri Shalini LTD

Comparative income statement

Particulars 2018 (`) 2019 (`) Absolute Precentage Increase

change (`) change (`) and

Decrease

Gross Sales 6,00,000 4,50,000 (1,50,000) 25% Decrease

Less : Sales Return 1,00,000 50,000 (50,000) 50% Decrease

5,00,000 4,00,000 (1,00,000) (20%) Decrease

Less : Cost of goods sold 3,00,000 2,00,000 (1,00,000) 33.33% Decrease

A 2,00,000 - -

Less : Opearting Expense 2,00,000

Office and Admin.Expenses 50,000 40,000 10,000 20% Decrease

Selling and Distribution 50,000 40,000 10,000 33.33% Decrease

Expenses

B 1,00,000 80,000 20,000 20% Decrease

Operating profit 1,00,000 1,20,000 20,000 20% Decrease

Add : Operating income 25,000 15,000 (10,000) 40% Decrease

Expenses

Less : Non Operating 5,000 5,000 - -

Expenses

Expenses 1,20,000 1,30,000 10,000 8.33 Decrease

Less : Tax 50% 60,000 65,000 5,000 8.33 Decrease

Net Profit after Tax 60,000 65,000 5,000 8.33 Decrease

373