Page 379 - VIRANSH COACHING CLASSES

P. 379

Operating Expense = Office and Admin. Expense + Selling and

Distribution Expenses

= 34,000 + 36,000 = ` 70,000

2,40,000 + 70,000

Operating Ratio = × 100 = 68.89 %

4,50,000

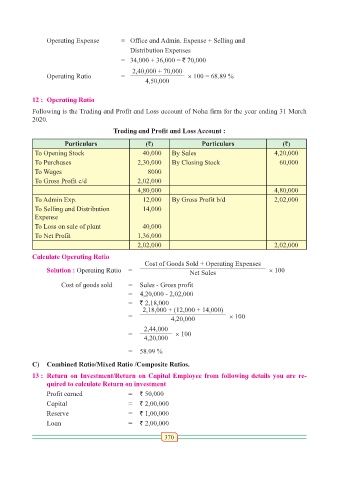

12 : Operating Ratio

Following is the Trading and Profit and Loss account of Noha firm for the year ending 31 March

2020.

Trading and Profit and Loss Account :

Particulars (`) Particulars (`)

To Opening Stock 40,000 By Sales 4,20,000

To Purchases 2,30,000 By Closing Stock 60,000

To Wages 8000

To Gross Profit c/d 2,02,000

4,80,000 4,80,000

To Admin Exp. 12,000 By Gross Profit b/d 2,02,000

To Selling and Distribution 14,000

Expense

To Loss on sale of plant 40,000

To Net Profit 1,36,000

2,02,000 2,02,000

Calculate Operating Ratio

Cost of Goods Sold + Operating Expenses

Solution : Operating Ratio = Net Sales × 100

Cost of goods sold = Sales - Gross profit

= 4,20,000 - 2,02,000

= ` 2,18,000

2,18,000 + (12,000 + 14,000)

= 4,20,000 × 100

2,44,000

= × 100

4,20,000

= 58.09 %

C) Combined Ratio/Mixed Ratio /Composite Ratios.

13 : Return on Investment/Return on Capital Employee from following details you are re-

quired to calculate Return on investment

Profit earned = ` 50,000

Capital = ` 2,00,000

Reserve = ` 1,00,000

Loan = ` 2,00,000

370