Page 380 - VIRANSH COACHING CLASSES

P. 380

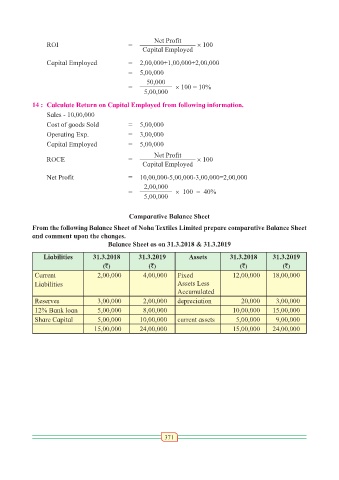

Net Profit

ROI = × 100

Capital Employed

Capital Employed = 2,00,000+1,00,000+2,00,000

= 5,00,000

50,000

= × 100 = 10%

5,00,000

14 : Calculate Return on Capital Employed from following information.

Sales - 10,00,000

Cost of goods Sold = 5,00,000

Operating Exp. = 3,00,000

Capital Employed = 5,00,000

Net Profit

ROCE = × 100

Capital Employed

Net Profit = 10,00,000-5,00,000-3,00,000=2,00,000

2,00,000

= × 100 = 40%

5,00,000

Comparative Balance Sheet

From the following Balance Sheet of Noha Textiles Limited prepare comparative Balance Sheet

and comment upon the changes.

Balance Sheet as on 31.3.2018 & 31.3.2019

Liabilities 31.3.2018 31.3.2019 Assets 31.3.2018 31.3.2019

(`) (`) (`) (`)

Current 2,00,000 4,00,000 Fixed 12,00,000 18,00,000

Liabilities Assets Less

Accumulated

Reserves 3,00,000 2,00,000 depreciation 20,000 3,00,000

12% Bank loan 5,00,000 8,00,000 10,00,000 15,00,000

Share Capital 5,00,000 10,00,000 current assets 5,00,000 9,00,000

15,00,000 24,00,000 15,00,000 24,00,000

371