Page 45 - VIRANSH COACHING CLASSES

P. 45

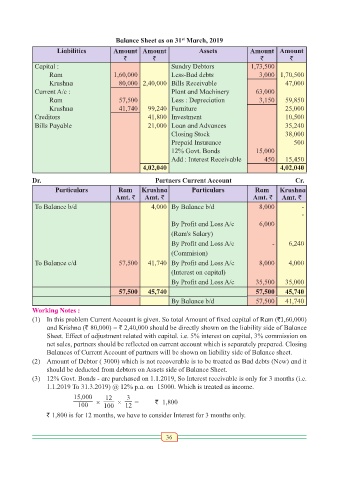

Balance Sheet as on 31 March, 2019

st

Liabilities Amount Amount Assets Amount Amount

` ` ` `

Capital : Sundry Debtors 1,73,500

Ram 1,60,000 Less-Bad debts 3,000 1,70,500

Krushna 80,000 2,40,000 Bills Receivable 47,000

Current A/c : Plant and Machinery 63,000

Ram 57,500 Less : Depreciation 3,150 59,850

Krushna 41,740 99,240 Furniture 25,000

Creditors 41,800 Investment 10,500

Bills Payable 21,000 Loan and Advances 35,240

Closing Stock 38,000

Prepaid Insurance 500

12% Govt. Bonds 15,000

Add : Interest Receivable 450 15,450

4,02,040 4,02,040

Dr. Partners Current Account Cr.

Particulars Ram Krushna Particulars Ram Krushna

Amt. ` Amt. ` Amt. ` Amt. `

To Balance b/d 4,000 By Balance b/d 8,000 -

-

By Profit and Loss A/c 6,000

(Ram's Salary)

By Profit and Loss A/c - 6,240

(Commision)

To Balance c/d 57,500 41,740 By Profit and Loss A/c 8,000 4,000

(Interest on capital)

By Profit and Loss A/c 35,500 35,000

57,500 45,740 57,500 45,740

By Balance b/d 57,500 41,740

Working Notes :

(1) In this problem Current Account is given. So total Amount of fixed capital of Ram (`1,60,000)

and Krishna (` 80,000) = ` 2,40,000 should be directly shown on the liability side of Balance

Sheet. Effect of adjustment related with capital. i.e. 5% interest on capital, 3% commission on

net sales, partners should be reflected on current account which is separately prepared. Closing

Balances of Current Account of partners will be shown on liability side of Balance sheet.

(2) Amount of Debtor ( 3000) which is not recoverable is to be treated as Bad debts (New) and it

should be deducted from debtors on Assets side of Balance Sheet.

(3) 12% Govt. Bonds - are purchased on 1.1.2019, So Interest receivable is only for 3 months (i.e.

1.1.2019 To 31.3.2019) @ 12% p.a. on 15000. Which is treated as income.

15,000 12 3

100 × 100 × 12 = ` 1,800

` 1,800 is for 12 months, we have to consider Interest for 3 months only.

36