Page 50 - VIRANSH COACHING CLASSES

P. 50

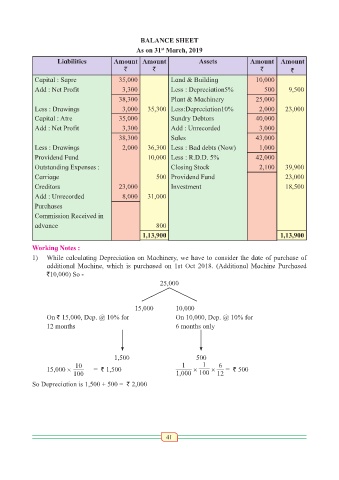

BALANCE SHEET

As on 31 March, 2019

st

Liabilities Amount Amount Assets Amount Amount

` ` ` `

Capital : Sapre 35,000 Land & Building 10,000

Add : Net Profit 3,300 Less : Depreciation5% 500 9,500

38,300 Plant & Machinery 25,000

Less : Drawings 3,000 35,300 Less:Depreciation10% 2,000 23,000

Capital : Atre 35,000 Sundry Debtors 40,000

Add : Net Profit 3,300 Add : Unrecorded 3,000

38,300 Sales 43,000

Less : Drawings 2,000 36,300 Less : Bad debts (Now) 1,000

Providend Fund 10,000 Less : R.D.D. 5% 42,000

Outstanding Expenses : Closing Stock 2,100 39,900

Carriage 500 Providend Fund 23,000

Creditors 23,000 Investment 18,500

Add : Unrecorded 8,000 31,000

Purchases

Commission Received in

advance 800

1,13,900 1,13,900

Working Notes :

1) While calculating Depreciation on Machinery, we have to consider the date of purchase of

additional Machine, which is purchased on 1st Oct 2018. (Additional Machine Purchased

`10,000) So -

25,000

15,000 10,000

On ` 15,000, Dep. @ 10% for On 10,000, Dep. @ 10% for

12 months 6 months only

1,500 500

10 1 1 6

15,000 × = ` 1,500 × × = ` 500

100 1,000 100 12

So Depreciation is 1,500 + 500 = ` 2,000

41