Page 54 - VIRANSH COACHING CLASSES

P. 54

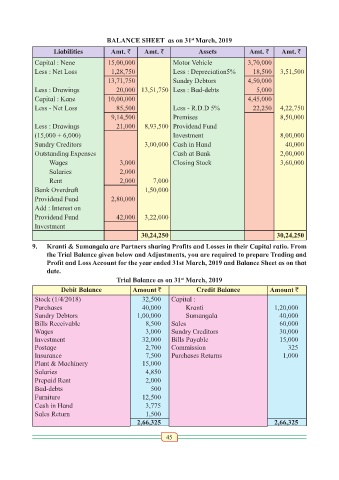

BALANCE SHEET as on 31 March, 2019

st

Liabilities Amt. ` Amt. ` Assets Amt. ` Amt. `

Capital : Nene 15,00,000 Motor Vehicle 3,70,000

Less : Net Loss 1,28,750 Less : Depreciation5% 18,500 3,51,500

13,71,750 Sundry Debtors 4,50,000

Less : Drawings 20,000 13,51,750 Less : Bad-debts 5,000

Capital : Kane 10,00,000 4,45,000

Less - Net Loss 85,500 Less - R.D.D 5% 22,250 4,22,750

9,14,500 Premises 8,50,000

Less : Drawings 21,000 8,93,500 Providend Fund

(15,000 + 6,000) Investment 8,00,000

Sundry Creditors 3,00,000 Cash in Hand 40,000

Outstanding Expenses Cash at Bank 2,00,000

Wages 3,000 Closing Stock 3,60,000

Salaries 2,000

Rent 2,000 7,000

Bank Overdraft 1,50,000

Providend Fund 2,80,000

Add : Interest on

Providend Fund 42,000 3,22,000

Investment

30,24,250 30,24,250

9. Kranti & Sumangala are Partners sharing Profits and Losses in their Capital ratio. From

the Trial Balance given below and Adjustments, you are required to prepare Trading and

Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as on that

date.

Trial Balance as on 31 March, 2019

st

Debit Balance Amount ` Credit Balance Amount `

Stock (1/4/2018) 32,500 Capital :

Purchases 40,000 Kranti 1,20,000

Sundry Debtors 1,00,000 Sumangala 40,000

Bills Receivable 8,500 Sales 60,000

Wages 3,000 Sundry Creditors 30,000

Investment 32,000 Bills Payable 15,000

Postage 2,700 Commission 325

Insurance 7,500 Purchases Returns 1,000

Plant & Machinery 15,000

Salaries 4,850

Prepaid Rent 2,000

Bad-debts 500

Furniture 12,500

Cash in Hand 3,775

Sales Return 1,500

2,66,325 2,66,325

45