Page 49 - VIRANSH COACHING CLASSES

P. 49

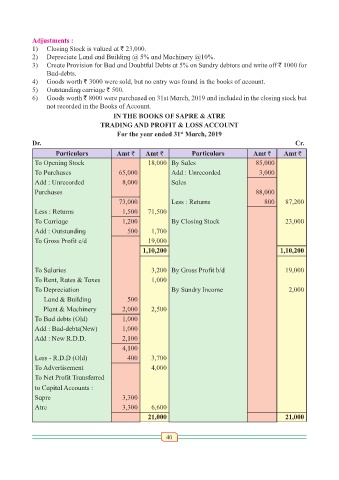

Adjustments :

1) Closing Stock is valued at ` 23,000.

2) Depreciate Land and Building @ 5% and Machinery @10%.

3) Create Provision for Bad and Doubtful Debts at 5% on Sundry debtors and write off ` 1000 for

Bad-debts.

4) Goods worth ` 3000 were sold, but no entry was found in the books of account.

5) Outstanding carriage ` 500.

6) Goods worth ` 8000 were purchased on 31st March, 2019 and included in the closing stock but

not recorded in the Books of Account.

IN THE BOOKS OF SAPRE & ATRE

TRADING AND PROFIT & LOSS ACCOUNT

For the year ended 31 March, 2019

st

Dr. Cr.

Particulars Amt ` Amt ` Particulars Amt ` Amt `

To Opening Stock 18,000 By Sales 85,000

To Purchases 65,000 Add : Unrecorded 3,000

Add : Unrecorded 8,000 Sales

Purchases 88,000

73,000 Less : Returns 800 87,200

Less : Returns 1,500 71,500

To Carriage 1,200 By Closing Stock 23,000

Add : Outstanding 500 1,700

To Gross Profit c/d 19,000

1,10,200 1,10,200

To Salaries 3,200 By Gross Profit b/d 19,000

To Rent, Rates & Taxes 1,000

To Depreciation By Sundry Income 2,000

Land & Building 500

Plant & Machinery 2,000 2,500

To Bad debts (Old) 1,000

Add : Bad-debts(New) 1,000

Add : New R.D.D. 2,100

4,100

Less - R.D.D (Old) 400 3,700

To Advertisement 4,000

To Net Profit Transferred

to Capital Accounts :

Sapre 3,300

Atre 3,300 6,600

21,000 21,000

40