Page 59 - VIRANSH COACHING CLASSES

P. 59

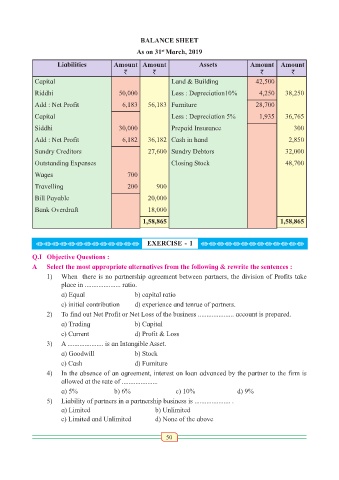

BALANCE SHEET

As on 31 March, 2019

st

Liabilities Amount Amount Assets Amount Amount

` ` ` `

Capital Land & Building 42,500

Riddhi 50,000 Less : Depreciation10% 4,250 38,250

Add : Net Profit 6,183 56,183 Furniture 28,700

Capital Less : Depreciation 5% 1,935 36,765

Siddhi 30,000 Prepaid Insurance 300

Add : Net Profit 6,182 36,182 Cash in hand 2,850

Sundry Creditors 27,600 Sundry Debtors 32,000

Outstanding Expenses Closing Stock 48,700

Wages 700

Travelling 200 900

Bill Payable 20,000

Bank Overdraft 18,000

1,58,865 1,58,865

HHHHHHHHHHHHH EXERCISE - 1 HHHHHHHHHHHHH

Q.I Objective Questions :

A Select the most appropriate alternatives from the following & rewrite the sentences :

1) When there is no partnership agreement between partners, the division of Profits take

place in ..................... ratio.

a) Equal b) capital ratio

c) initial contribution d) experience and tenrue of partners.

2) To find out Net Profit or Net Loss of the business ..................... account is prepared.

a) Trading b) Capital

c) Current d) Profit & Loss

3) A ..................... is an Intangible Asset.

a) Goodwill b) Stock

c) Cash d) Furniture

4) In the absence of an agreement, interest on loan advanced by the partner to the firm is

allowed at the rate of .....................

a) 5% b) 6% c) 10% d) 9%

5) Liability of partners in a partnership business is ..................... .

a) Limited b) Unlimited

c) Limited and Unlimited d) None of the above

50