Page 9 - Test File

P. 9

The Point

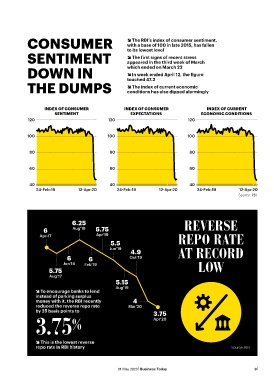

consumer î The RBI’s index of consumer sentiment,

with a base of 100 in late 2015, has fallen

No Bet oN ICRA -2 Goldman 1.6 5.8 sentIment to its lowest level

-1

Sachs

î The first signs of recent stress

ecoNomic UBS -0.4 2.5 Crisil 1.8 3.5 down In appeared in the third week of March

which ended on March 22

RecoveRy Barclays 0 3.5 S&P Global 1.8 3.5 the dumPs î In week ended April 12, the figure

touched 47.2

Ratings

î The index of current economic

iN Fy21 CMIE 0.1 6.1 Fitch 1.8 4.6 conditions has also dipped alarmingly

Solutions

Index of current

î Most agencies have sharply Fitch 0.2 1.9 Index of consumer Index of consumer economIc condItIons

sentIment

exPectatIons

lowered their GDP growth Ratings 2.5 IMF 5.8

projection for FY21 120 120 120

î GDP growth was 5.6 per SBI 1.1 India Ratings 1.9

cent in the June 2019 quarter Ecowrap 2.5 and Research 3.6

and 4.7 per cent in the 100 100 100

December 2019 quarter DBS Bank 1.5 EIU 2.1

î The reason for the expected 3.3 6 80 80 80

sharp slowdown is lockdown

imposed by the government World 1.5 Moody’s 2.5

to contain coronavirus Bank 4.8 5.3

60 60 60

Latest forecast

Previous forecast Figures in %; Source: RBI

40 40 40

24-Feb-19 12-Apr-20 24-Feb-19 12-Apr-20 24-Feb-19 12-Apr-20

Source: RBI

Incomes

suffer 45.7 % 6.25 ReveRse

Lockdown income in a survey Apr-17 Aug'18 5.75 Repo Rate

6

households

reported a fall in

Apr'19

5.5

BLow on April 12 Jun'19 4.9 at RecoRd

6

6

80 (Figures in %) î This is a sharp Jun'18 Feb'19 Oct'19

rise from 14 per

70 Households cent on March 5.75 Low

with no 22, the period Aug'17

60 change in coinciding with the

income imposition of the 5.15

50 Aug'19

Households lockdown î To encourage banks to lend

40 with fall in instead of parking surplus

income money with it, the RBI recently 4

30 Only reduced the reverse repo rate Mar'20

Households by 25 basis points to

20 with rise in 10.6 % 3.75

income Apr'20

10 3.75 %

Source: CMIE households

0 Household incomes, the least

reported rise in

Survey

01-Dec-19 08-Dec-19 15-Dec-19 22-Dec-19 29-Dec-19 05-Jan-20 12-Jan-20 19-Jan-20 26-Jan-20 02-Feb-20 09-Feb-20 16-Feb-20 23-Feb-20 01-Mar-20 08-Mar-20 15-Mar-20 22-Mar-20 29-Mar-20 05-Apr-20 12-Apr-20 December 2019 î This is the lowest reverse Source: RBI

since at least

repo rate in RBI history

8 Business Today 31 May 2020 31 May 2020 Business Today 9