Page 71 - ISU Echague LUDIP

P. 71

TABLE OF CONTENTS

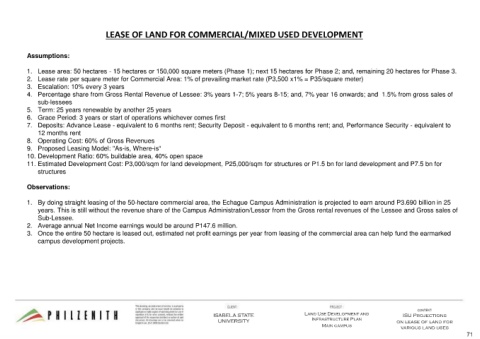

LEASE OF LAND FOR COMMERCIAL/MIXED USED DEVELOPMENT

Assumptions:

1. Lease area: 50 hectares - 15 hectares or 150,000 square meters (Phase 1); next 15 hectares for Phase 2; and, remaining 20 hectares for Phase 3.

2. Lease rate per square meter for Commercial Area: 1% of prevailing market rate (P3,500 x1% = P35/square meter)

3. Escalation: 10% every 3 years

4. Percentage share from Gross Rental Revenue of Lessee: 3% years 1-7; 5% years 8-15; and, 7% year 16 onwards; and 1.5% from gross sales of

sub-lessees

5. Term: 25 years renewable by another 25 years

6. Grace Period: 3 years or start of operations whichever comes first

7. Deposits: Advance Lease - equivalent to 6 months rent; Security Deposit - equivalent to 6 months rent; and, Performance Security - equivalent to

12 months rent

8. Operating Cost: 60% of Gross Revenues

9. Proposed Leasing Model: "As-is, Where-is“

10. Development Ratio: 60% buildable area, 40% open space

11. Estimated Development Cost: P3,000/sqm for land development, P25,000/sqm for structures or P1.5 bn for land development and P7.5 bn for

structures

Observations:

1. By doing straight leasing of the 50-hectare commercial area, the Echague Campus Administration is projected to earn around P3.690 billion in 25

years. This is still without the revenue share of the Campus Administration/Lessor from the Gross rental revenues of the Lessee and Gross sales of

Sub-Lessee.

2. Average annual Net Income earnings would be around P147.6 million.

3. Once the entire 50 hectare is leased out, estimated net profit earnings per year from leasing of the commercial area can help fund the earmarked

campus development projects.

CONTENT:

ISABELA STATE Land Use Development and ISU Projections

UNIVERSITY Infrastructure Plan on lease of land for

Main campus

various land uses

71