Page 32 - BLEEDED DIARIO 12 FEB

P. 32

lendingbythepensionfundsfellbyAfl.3.9million(chart3).

enterprises of, respectively, Afl. 9.9 million (to Afl. 1,038.8 million) and Afl. 4.4 million (to Afl. 1,322.5

million).Incontrast,consumercreditdroppedbyAfl.4.6million(toAfl.590.1million).

PAGINA 32 Interestratemargin DIARIO DIAHUEBS 12 FEBRUARI 2015

In the third quarter of 2014, the interest rate margin of the commercial banks (calculated as the

differential between the weighted average rate of interest paid on new loans and the weighted

averagerateofinterestofferedonnewdeposits)increasedby0.1percentagepointto6.2percent,

caovemrpagaererdattoetohfeinsteecroensdtoqfufaerrteedroonf2n0e1w4(dCehpaortsi2t)s.aTnhdisirnestuhletewdefirgohmteddeacrveearasegseinrabteotohftihnetewreesigthptaeidd

C E N oTnR nAeLwE loBanAsNofK, reVspAeNctivAelRy,U 0B.9A percentage point to 1.6 percent and 0.7 percentage point to 7.9

percent. Desaroyo monetario y financiero:

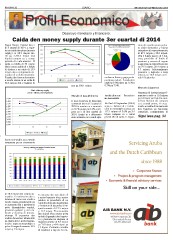

Caida den money supply durante 3er cuartal di 2014NewsRelease

AtendǦSeptember2014,themarketshareofthecommercialbanks,pensionfunds,mortgagebanks,

life insurance companies and other financial institutions remained unchanged at, respectively, 64

ary6,2015 percent,16percent,12percent,7percent,and1percent,comparedtoendǦJune2014(chart4).

Segun Banco Central den e sion aki a wordo causa pa tan-

ndfinadnic3ialcdueavretalolpdmi e2n0ts1:4M, oanreeygsiusp- plydecreasedinthethirdquarterof2014 to claim domestico y bienes

tra un caida den placa (money estranhero di respectivamente

reditsupply) cu 68.9 miyon flo- di 87.1 miyon y 30.0 miyon.

quartbreiirnyoofnp2)a0c134o.,m3t5hp3ea.r2ma ocmnueiyyeosnuepmp(s3luy.n4decreased byAfl.68.9milliontoAfl.3,353.2million, Den e banda pasivo di e bal-

otheppreervioioduosdqiuaertaeñra(Cahnatretr1io).r.ThiEsdeclineresultedfromanAfl.55.0millionoutflowof ansa, provision di fondo di

pensioen y reserva di seguro

dsandcaanidAafla.13r.e9sumltilaliodnid5e5cremasiyeoinnthedomesticcomponentofthemoneysupply.The a aumenta cu respectivamente

et domfleosrtiinc acsosmetos wsaalisd aassdoiceiatfeodndwoith an Afl. 52.6 million decrease in nonǦcredit related cu 79.3 miyon, 28.4 miyon y

eint nitoenmdmmǦicseir,ydsewotidivnchiitosidcrahdeesnilawyeteaeousdcfnolebarmrcatgaalpaeiomndlyncaoeeondnfsefithsetae1eredt3ito.ob9-i.yte amns A wfla.s38c.a7u mseidlliolanrggerloyw btyh inincrdeoamseess itnic t hcree bdaitl.a Tnhcee 9.3 miyon. Adicionalmente

s “shEarechaoidldaedrse’n ebqieuniteys”,d o“mgeensteircaol provisions” and “other liabilities” and clearing prestamo y deposito a keda

mescos na 38.9 miyon na fi-

ca den un fianza y pago pa de- nal di September.

s. Theaewxpoarndsoioansoincidaocmueusnticcacirdeadidtiwas due to rises in claims of the banking sector on positonan nobo). E caida den

esaki ta 0.9% punto pa 1.6% y

blicse5c2to.6ramndiypornivadteenseectboarlaonf,sraesdpiectively,Afl.30.8millionandAfl.7.9million.

Nonmonetaryfinancialinstitutions yon pa 590.1 miyon. 0.7% pa 7.9%.

Mercado di hypoteca

AtendǦSeptember2014,theaggregatedbalancesheettotaloftheno nmonetaryfinancialinstitutions 3 Hypoteca di institucionnan fi-

grew by Afl. 117.1 million or 3.6 percent tboo tAhfl.n 3e,t3M7d3ao.4rmgmeinsiltlidicoinct,alacziomamsdpiaairnneddtenrtoeetsenfodrǦeJuignnnIenoa2ss0mtsi1te4out.nscTeiohotainfs,rniaan nanciero a subi cu 11.0 miyon

expansion was caused by increases in financiero pa 1.6 biyon na final di e cuar-

tal bao revision aki compara

respectively,Afl.87.1millionandAfl.30.0million.OnEthtaezlaiadbiilitiyntseidrees,odtihebranitceomnsannet,pensionfund

provisionsandinsurancereservefundwentupby,recsopmecetricviealyl ,dAefnl.e79d.i33mciluliaornt,aAl fdl.i28.4Nmailflionnaladndi September (2014) cu e cuartal prome. E crece-

Afl.9.3million.Inaddition,borrowingsanddeposits20re1m4atianemdusntcrhaacnugeadautmAfel.n3ta8.9msiellgiounnaettbhaelansa di e institu- mento a resulta di un aumento

cu 0.1% punto pa 6.2%, com- cion no monetario a crece cu den hypoteca pa banconan

endofSeptember2014. para cu e di dos cuartal di 117.1 miyon of 3.6% pa 3.4 comercial, companianan di

Mortgagemarket 2014. (esaki ta e diferencia biyon compara cu e cartal Sigui lesa pag. 34

entre e interes cu ta wirdi apli- prome (fin di Juni). E expan-

HousingmortgagelendingofthefinancialinstitutionsrosebyAfl.11.0milliontoAfl.1,608.0millionat

the end of September 2014, compared to endǦJune 2014. This growth resulted from increases in

housing mortgage lending by the commercial banks, life insurance companies and mortgage banks

2

ively, Afl. 9.8 million, Afl. 3.2 million and Afl. 1.7 million. In contrast, housing mortgage

ethinenpeitntecsmiloainsmfnsuonondf-stchfreeldlbibaty,nkAciufnl.ga3s.9wecmotorildrliooonn(tchheaprtu3b)l.icsectorstemmedmainlyfromdecreases

entdecpoomsiptseannsaddpeaveulnopcmreecnetmfuenndtsoof,respectively,Afl.15.5millionandAfl.11.4million.

in claims on the private sector was due to gains in housing mortgages and loans to

1

tcpeeemrccboeebmdmnriatep2l,3sa0a18tn2n1i.4sci7pe,aoestm.rhdcaEeiienynmidocttenoa,omnr7tdkthpseereaentnrcrsocccfherniinaeon-radncten,irtaecodoindfeadidnlttho1ineae-pscetoirtcmuEpeetumnisoabteen,ulcriscmtccooioraemrelnmbptbtaaoaaanrninepcdkdearesodrn,ticopoueneendrennicetsbdhniacoǦatJlenneuaginfsmdeueeidncs2dt0uaods1tn,ri4,mr(ecoshrptageratcgt4ie)v.eblay,n k6s4,

wordo causa grandemente pa caida den deposito di gobierno

un aumento den e patrimonio y fondonan di desaroyo di re-

netto (shareholders equity), spectivamente di 15.5 miyon

provision general y otro de- y 11.4 miyon. E crecemento

benan y clearing di transac- den claims riba e sector priva

cionnan. E expansion den ta debi di ganashi den hypote-

credito domestico tabata debi ca y prestamo na empresa di

na claims den e sector bancar- respectivamente di 9.9 miyon

io riba tanto sector publico y pa 1.0 biyon y 4.4 miyon pa

priva di respectivamente 30.8 1.3 biyon. Contrario e credito

miyon y 7.9 miyon.

di consumo a cay cu 4.6 mi-