Page 374 - COSO Guidance

P. 374

4 | Creating and Protecting Value: Understanding and Implementing Enterprise Risk Management

Board guidance published in South Africa offers a quick, ERM helps organizations identify, assess and manage the

useful way to think about the relationship between the risks to their strategies. It is a practical way to create and

board and strategy, risk, performance, sustainability, protect value and should be an integral part of the strategy

and value creation. See Example 1 below. The board is selection process. Understanding the role of ERM is key to

responsible for the oversight of the organization’s strategies avoiding a common mistake many organizations make. ERM

and their related risks. While it may delegate day-to- is not a separate, stand-alone function but is embedded

day responsibilities to management, it retains ultimate in the fabric of how the organization sets and monitors its

responsibility for oversight seeing that management is strategies and helps enhance the overall performance of

achieving the strategy and business objectives. Example 1 the organization. It also answers a question that some ask,

also introduces the concept of sustainability, the need for which is “What is the real value of ERM?” If you attempt

the organization to focus on value creation for the long term to answer that question with a separate, not aligned ERM

not just short-term maximization. activity, the answer is often unclear. If ERM is understood

and positioned as described by COSO, however, the answer

becomes clear; its benefit is improved decision making and

EX AMPLE 1 ultimately improved performance of the organization as it

The Relationship between Strategy, Risk, strives to meet its mission and achieve its strategies and

Performance and Value Creation business objectives.

Understanding and supporting these objectives for ERM are

The governing body should appreciate that critical for boards and managements to both help improve

the organization’s core purpose, its risks their organizations and to understand the benefit and return

and opportunities, strategy, business model, for an investment in ERM.

performance, and sustainable development

are all inseparable elements of the value

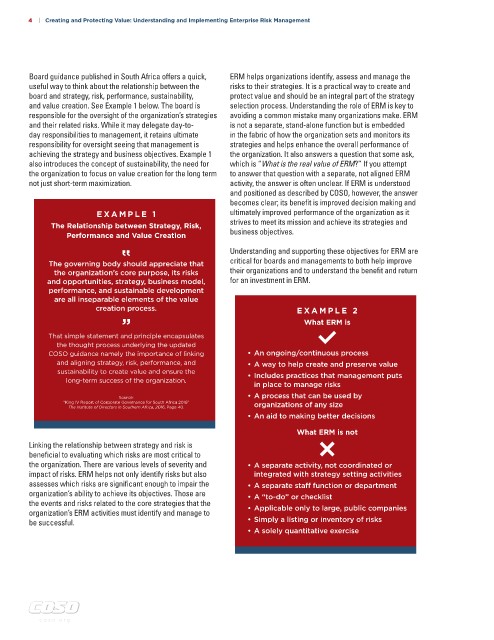

creation process. EX AMPLE 2

What ERM is

That simple statement and principle encapsulates

the thought process underlying the updated

COSO guidance namely the importance of linking • An ongoing/continuous process

and aligning strategy, risk, performance, and • A way to help create and preserve value

sustainability to create value and ensure the • Includes practices that management puts

long-term success of the organization.

in place to manage risks

• A process that can be used by

Source:

“King IV Report of Corporate Governance for South Africa 2016” organizations of any size

The Institute of Directors in Southern Africa, 2016, Page 40.

• An aid to making better decisions

What ERM is not

Linking the relationship between strategy and risk is

beneficial to evaluating which risks are most critical to

the organization. There are various levels of severity and • A separate activity, not coordinated or

impact of risks. ERM helps not only identify risks but also integrated with strategy setting activities

assesses which risks are significant enough to impair the • A separate staff function or department

organization’s ability to achieve its objectives. Those are • A “to-do” or checklist

the events and risks related to the core strategies that the • Applicable only to large, public companies

organization’s ERM activities must identify and manage to

be successful. • Simply a listing or inventory of risks

• A solely quantitative exercise

c oso . or g