Page 616 - COSO Guidance

P. 616

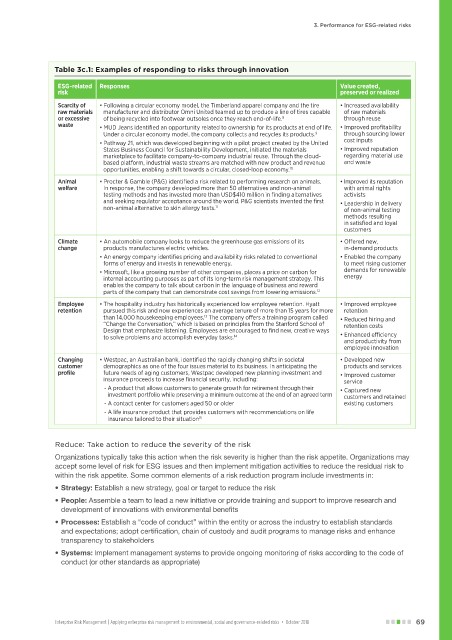

3. Performance for ESG-related risks

Table 3c.1: Examples of responding to risks through innovation

ESG-related Responses Value created,

risk preserved or realized

Scarcity of • Following a circular economy model, the Timberland apparel company and the tire • Increased availability

raw materials manufacturer and distributor Omni United teamed up to produce a line of tires capable of raw materials

or excessive of being recycled into footwear outsoles once they reach end-of-life. through reuse

8

waste • MUD Jeans identified an opportunity related to ownership for its products at end of life. • Improved profitability

Under a circular economy model, the company collects and recycles its products. through sourcing lower

9

• Pathway 21, which was developed beginning with a pilot project created by the United cost inputs

States Business Council for Sustainability Development, initiated the materials • Improved reputation

marketplace to facilitate company-to-company industrial reuse. Through the cloud- regarding material use

based platform, industrial waste streams are matched with new product and revenue and waste

opportunities, enabling a shift towards a circular, closed-loop economy. 10

Animal • Procter & Gamble (P&G) identified a risk related to performing research on animals. • Improved its reputation

welfare In response, the company developed more than 50 alternatives and non-animal with animal rights

testing methods and has invested more than USD$410 million in finding alternatives activists

and seeking regulator acceptance around the world. P&G scientists invented the first • Leadership in delivery

non-animal alternative to skin allergy tests. of non-animal testing

11

methods resulting

in satisfied and loyal

customers

Climate • An automobile company looks to reduce the greenhouse gas emissions of its • Offered new,

change products manufactures electric vehicles. in-demand products

• An energy company identifies pricing and availability risks related to conventional • Enabled the company

forms of energy and invests in renewable energy. to meet rising customer

• Microsoft, like a growing number of other companies, places a price on carbon for demands for renewable

internal accounting purposes as part of its long-term risk management strategy. This energy

enables the company to talk about carbon in the language of business and reward

parts of the company that can demonstrate cost savings from lowering emissions. 12

Employee • The hospitality industry has historically experienced low employee retention. Hyatt • Improved employee

retention pursued this risk and now experiences an average tenure of more than 15 years for more retention

than 14,000 housekeeping employees. The company offers a training program called • Reduced hiring and

13

“Change the Conversation,” which is based on principles from the Stanford School of retention costs

Design that emphasize listening. Employees are encouraged to find new, creative ways

14

to solve problems and accomplish everyday tasks. • Enhanced efficiency

and productivity from

employee innovation

Changing • Westpac, an Australian bank, identified the rapidly changing shifts in societal • Developed new

customer demographics as one of the four issues material to its business. In anticipating the products and services

profile future needs of aging customers, Westpac developed new planning investment and • Improved customer

insurance proceeds to increase financial security, including: service

- A product that allows customers to generate growth for retirement through their • Captured new

investment portfolio while preserving a minimum outcome at the end of an agreed term customers and retained

- A contact center for customers aged 50 or older existing customers

- A life insurance product that provides customers with recommendations on life

insurance tailored to their situation 15

Reduce: Take action to reduce the severity of the risk

Organizations typically take this action when the risk severity is higher than the risk appetite. Organizations may

accept some level of risk for ESG issues and then implement mitigation activities to reduce the residual risk to

within the risk appetite. Some common elements of a risk reduction program include investments in:

• Strategy: Establish a new strategy, goal or target to reduce the risk

• People: Assemble a team to lead a new initiative or provide training and support to improve research and

development of innovations with environmental benefits

• Processes: Establish a “code of conduct” within the entity or across the industry to establish standards

and expectations; adopt certification, chain of custody and audit programs to manage risks and enhance

transparency to stakeholders

• Systems: Implement management systems to provide ongoing monitoring of risks according to the code of

conduct (or other standards as appropriate)

Enterprise Risk Management | Applying enterprise risk management to environmental, social and governance-related risks • October 2018 69