Page 210 - Other Income for Individuals

P. 210

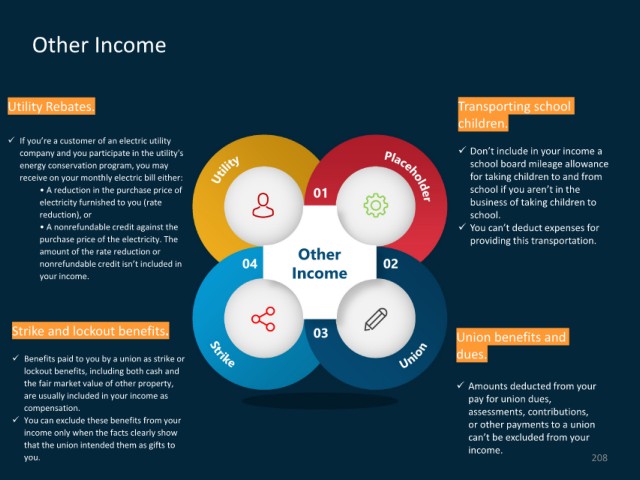

Other Income

Utility Rebates. Transporting school

children.

If you’re a customer of an electric utility

company and you participate in the utility's Don’t include in your income a

energy conservation program, you may school board mileage allowance

receive on your monthly electric bill either: for taking children to and from

• A reduction in the purchase price of 01 school if you aren’t in the

electricity furnished to you (rate business of taking children to

reduction), or school.

• A nonrefundable credit against the You can’t deduct expenses for

purchase price of the electricity. The providing this transportation.

amount of the rate reduction or Other

nonrefundable credit isn’t included in 04 02

your income. Income

Strike and lockout benefits. 03 Union benefits and

dues.

Benefits paid to you by a union as strike or

lockout benefits, including both cash and

the fair market value of other property, Amounts deducted from your

are usually included in your income as pay for union dues,

compensation. assessments, contributions,

You can exclude these benefits from your or other payments to a union

income only when the facts clearly show can’t be excluded from your

that the union intended them as gifts to income.

you. 208